There are two types of aging reports for both Accounts Payable and Accounts Receivable. The aging summary reports let a business see all their vendors or customers in a summarized table with the number of days outstanding. The aging detail reports also let’s them see all the accounts in order of their due dates. With an aging report, they know what’s due, when, and which accounts need extra attention.

Aging reports are a must-have for any business, so let’s look at what they are and how they are used to ensure a healthy cash flow.

What is an accounts receivable aging report?

Accounts receivable (AR) aging reports clue businesses on which clients are slow-paying or overdue. It shows them which customer accounts to watch and which ones deserve a follow-up to address past-due invoices.

An AR aging summary report categorizes accounts receivable — the money owed by customers — by the number of days an invoice is outstanding.

AR aging summary report example

Let’s look at an accounts receivable aging summary report to see how it works.

Dale’s Shipping & Logistics has a handful of overdue accounts.

Accounts receivable aging has columns that are separated into 30 day increments. This represents the total receivables that are currently due for each customer as well as those that are past due for each 30-day time period. Dale’s Shipping & Logistics has a total of $80,000 past due from its customers. If customer accounts get too far past due the business could potentially run into cash flow issues if accounts receivable is not properly managed.

The benefits of accounts receivable aging reports

Accounts receivable aging reports are valuable tools that help businesses gain insights into their outstanding and pending invoices, as well as the payment behavior of their customers. These reports allow a company to track and manage their receivables more efficiently.

With AR aging reports, identifying potential issues and complications is easier. An accounts receivable aging report provides a clear overview of outstanding balances and the length of time that invoices have been outstanding. Thus, aging reports enable businesses to take proactive measures to ensure timely collections and mitigate the risk of bad debts. Accounts receivable is a critical part of any business to ensure enough money is coming in to cover expenses.

Identify late-paying customers

With an accounts receivable aging report, it’s easy to compare customer's invoices and see which customers regularly pay late. This information can help in making decisions about credit policies, follow-up communications, and whether or not a company wants to continue their relationship with certain customers.

Adjust credit policies

Since an aging report reveals who late-paying customers are, a business will also know where to adjust their credit policies. For example, if several customers regularly pay their invoices late, a company might need to set stricter payment terms, such as a shorter due date or a late-payment penalty.

If they only have one or two customers with outstanding invoices, then they can take the necessary steps to collect payment without affecting the rest of their customers.

Avoid cash flow issues

Accounts receivable aging reports also help businesses avoid cash flow issues by providing insights into the status of outstanding invoices and enabling proactive measures to be taken. An AR aging report allows companies to plan and implement collection strategies to ensure they are properly paid, as well as more effectively arrange their future expenses.

They can also identify patterns in payment behavior and predict future cash inflows more accurately by analyzing aging reports. This information allows businesses to better manage cash flow and plan expenditures, investments, and operational activities accordingly. By clearly understanding the expected cash inflows, an accounting department can mitigate potential gaps and make informed decisions to avoid liquidity issues.

Utilizing accounts receivable aging reports also helps strike a balance between ensuring a business receives payment while also offering flexible payment options to their customers to maintain stronger relationships with them. For more help with tracking and creating accounts receivable reports, use BILL’s accounts receivable system. BILL offers several built-in reports including AR Aging Summary Report, AR Aging Detail Report, Open Invoices, and more.

What is an accounts payable aging report?

Accounts payable (AP) aging detail reports let a business see all their due dates at a glance. They can quickly find out who to pay and when so that they pay suppliers on time and potentially capitalize on early payment discounts. The accounts payable aging summary reports categorizes accounts payable — the money owed by the company — by the number of days a payable is outstanding.

AP aging summary report example

Let’s look at an example of an AP aging summary report to see how it works.

Luminova Solutions has a handful of overdue invoices due to their vendors.

Accounts payable aging has columns that are separated into 30 day increments. This represents the total payables that are currently due to vendors as well as those that are past due for each 30-day time period. Luminova Solutions has a total of $7,700 past due invoices for its vendors. If Luminova Solutions’ accounts get too far past due the vendors could potentially charge late fees or potentially stop providing services until the account is current.

The benefits of AP aging reports

Accounts payable (AP) aging reports serve as valuable tools for businesses to gain insights into outstanding payment obligations to suppliers and vendors.

These reports provide a detailed breakdown of payables based on their aging status, enabling businesses to assess their financial liabilities and take necessary action.

By analyzing AP aging reports, a company can prioritize payments and foster positive relationships with suppliers — ensuring a smooth operation and their financial stability.

Negotiate better terms with vendors

AP aging reports provide businesses with a comprehensive view of their outstanding payables and reduce late payments. This information can be valuable for building strong and trusting relationships with suppliers.

Analyzing the report and building those relationships allows one to identify negotiation opportunities, such as requesting extended payment terms or discounts for early payment.

Build and maintain positive relationships

AP aging reports provide a clear overview of outstanding payments that need to be made to suppliers and vendors. By categorizing payables based on their aging status, businesses can identify which invoices are past due or approaching their due dates — ensuring timely payment of bills, avoiding late fees, and maintaining positive relationships with suppliers.

Keep payments organized

AP aging schedule reports also help a business stay organized and up-to-date on upcoming payment obligations. Regularly reviewing the aging report allows them to make sure all bills are paid on time, minimizing the risk of disruption to the supply chain and keeping the business running smoothly.

BILL’s Accounts Payable system can make creating AP aging reports simple and effective so that any sized business can precisely stay on top of their finances. BILL offers several built-in reports including AP Aging Summary Report, AP Aging Detail Report, Vendor Balance Detail, and more.

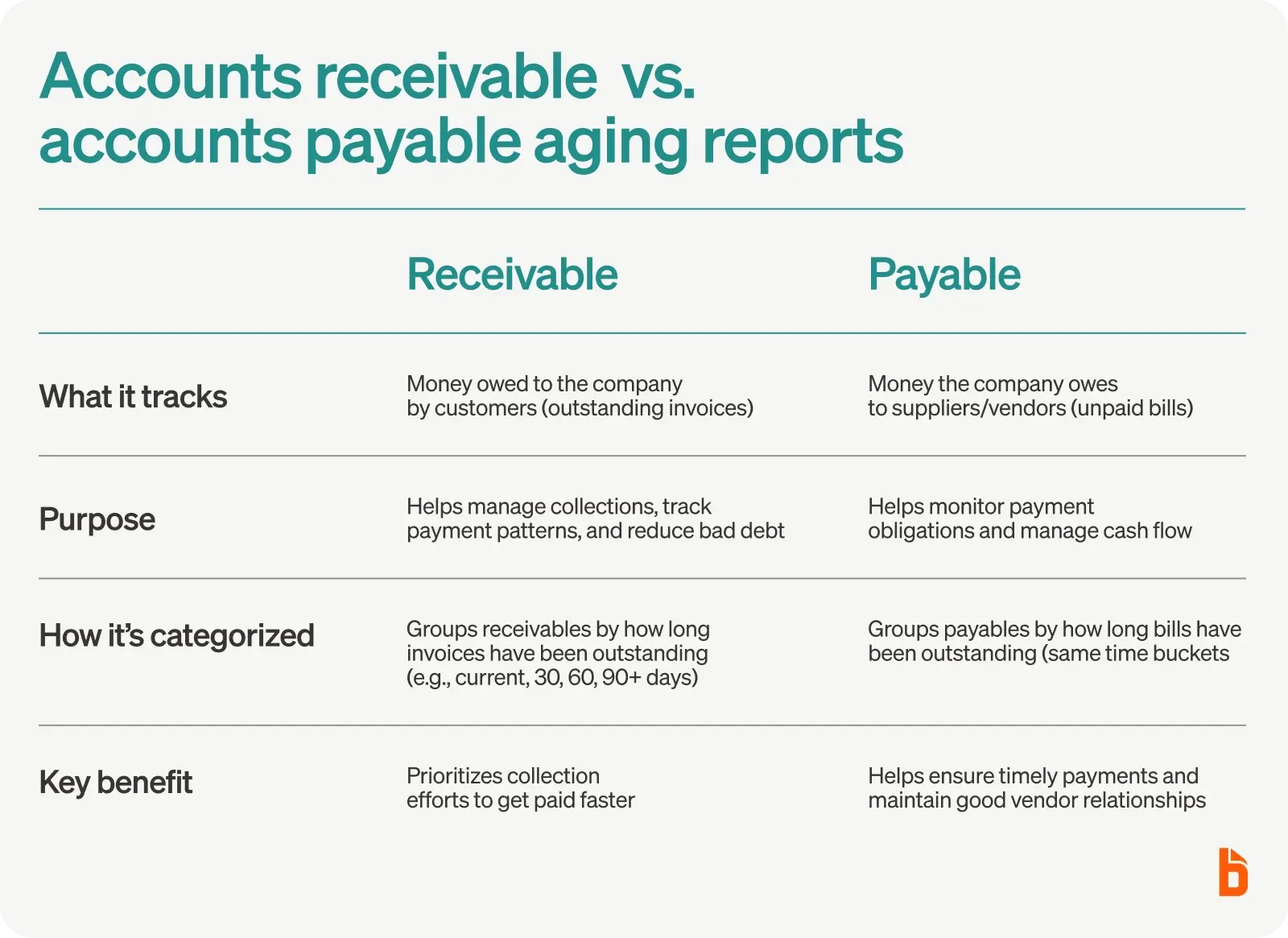

Accounts payable aging reports vs. accounts receivable aging reports

The main difference between an accounts receivable aging report and an accounts payable aging report is the nature of the transactions each report tracks.

Accounts receivable aging reports focus on the company's outstanding customer invoices and the amounts that are owed to the business.

It provides a breakdown of the company's accounts receivable based on the length of time the invoices have been outstanding, typically in categories such as current, 30 days, 60 days, and 90+ days.

These reports help businesses track and manage unpaid customer invoices, monitor payment patterns, and prioritize collection efforts.

Accounts payable aging reports focus on the company's outstanding liabilities to suppliers and vendors. It provides a snapshot of the amounts owed to external parties for goods or services received but not yet paid for.

The accounts aging report then categorizes these payables based on the range of time they have been outstanding, typically in the same increments as accounts receivable aging reports. Overall, the AP aging report helps businesses monitor and manage their outstanding payment obligations.

How aging reports can help a business stay financially healthy

Aging reports play a pivotal role in providing businesses with comprehensive insights into their cash flow problems and the status of their outstanding invoices and bills.

Fully utilizing aging reports can ensure a company will have healthy cash flow, mitigate risks, and make informed decisions to create a solid foundation for long-term financial health.

Cash Flow Management

Aging reports provide a clear picture of outstanding accounts receivable and payable, allowing businesses to monitor their cash flow effectively.

Analyzing the aging report helps identify any imbalances between incoming and outgoing funds, and thus helps a company allocate its resources effectively while ensuring there is enough to cover expenses and manage any potential gaps.

Risk Assessment and Mitigation

Aging reports provide insights into the creditworthiness and payment behavior of customers and suppliers. By reviewing the aging report, a company can quickly discover which customers consistently delay payments or what suppliers have frequent billing errors.

This helps them assess and mitigate greater potential credit risks, and also provides clarity to make informed decisions about credit limits, contract renewals, or potential changes in suppliers to minimize financial exposure.

Aging reports are powerful tools that assist businesses in maintaining financial health. Regularly reviewing and utilizing aging reports enables businesses to make sound financial decisions, proactively address financial challenges and credit risks, and foster the long-term financial stability of the business.

Better manage your cash flow with aging reports

Accounts receivable and accounts payable aging reports are valuable tools for managing a company’s cash flow. Every business needs both to help paint a clearer picture of the money coming in and going out of their cash flow. Use BILL to help manage your accounts payable and accounts receivable with stellar built-in aging reports available.