There’s a lot of work that goes into processing invoices–especially if your team is still completing these workflows manually.

They need to ensure that the invoices they’re receiving from vendors match up against a legitimate purchase order, time payments to take advantage of early payment discounts, track down approvals, and avoid making late payments to keep vendors happy.

When performed manually, invoice processing can be tedious and repetitive, even though it’s an essential accounts payable workflow.

Instead, you can save time and improve efficiency by automating the manual work that goes into this process.

Below, we’ll discuss what automated invoice processing is, how it can benefit your accounts payable department, and some tips for successfully transitioning to an automated invoice processing system.

What is automated invoice processing?

Automated invoice processing uses digital systems to simplify the manual work that goes into paying invoices–essentially putting this task on autopilot.

This is typically a function available through your accounting or accounts payable software (like BILL), which will automatically pull the necessary data from invoices, store the information, and help you make payments to vendors on time.

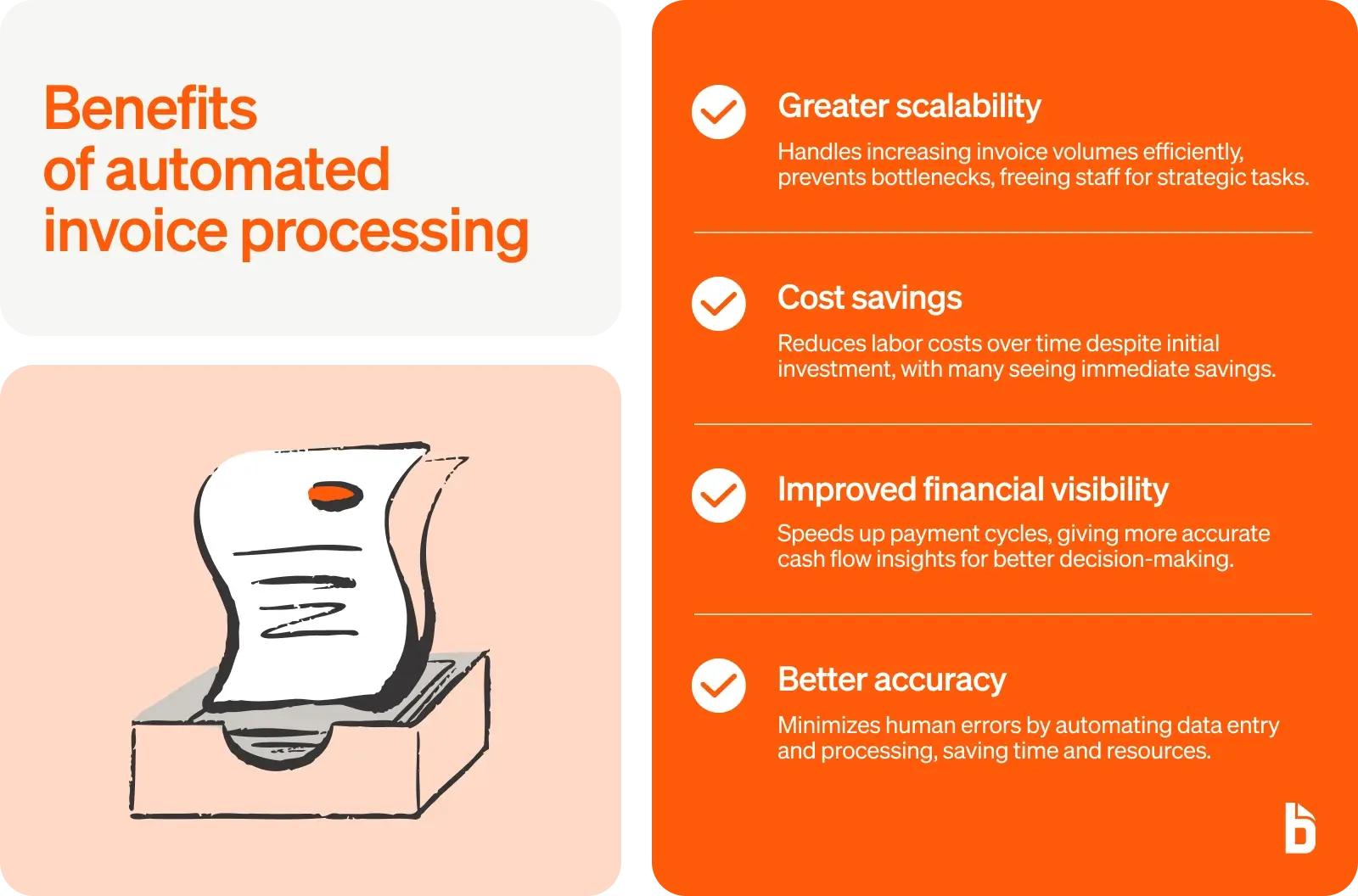

The benefits of automated invoice processing

Compared to the traditional method of processing invoices manually, here are some of the notable benefits that an automated invoice processing system can offer:

Greater scalability

As your business grows and starts to add more vendors, invoice processing becomes a highly demanding process that can exceed your team’s capacity.

At some point, invoices may stack up on your team’s desk faster than they can reasonably process them, which can lead to late payments, penalties, and fees.

Automating your workflow can help you avoid bottlenecks and meaningfully increase the number of invoices you can process each day.

You can quickly scale up or down your automated invoice processing system as needed to meet the flow of incoming invoices.

In turn, this gives your accounts payable team valuable time back in their days to focus on more strategic tasks that require critical thinking and support your financial objectives.

Cost savings

Another clear benefit of using an automated invoice processing system is that it could result in lower labor costs over the long term by helping your team become more efficient.

Of course, you will need to make an upfront investment in an automated AP solution if you don’t already have one.

But, using an automated solution can result in clear cost savings for the business over the long run.

According to some estimates, certain cost savings can be felt immediately.

One survey shows that more than a quarter of small and medium businesses believe that implementing AI/automation will save them at least $5,000 within the next year.

Improved financial visibility

An automated invoice processing system can help you accomplish a quicker payment cycle, giving your finance department a more accurate picture of your current cash flow levels.

If you’re not dependent on your team’s finite resources to process invoices, this workflow can occur much more quickly, reducing the amount of time between procurement and payment.

When invoices go a few weeks before being paid, you may have an inflated view of your cash flows since the payment has not yet left your account.

The improved visibility of your cash flows supported by an automated invoice processing system can help drive more informed decision-making related to purchasing, budgeting, and more.

Better accuracy

When invoices are processed manually, there is always room for human error, as you can’t expect your team to never make mistakes.

Even though such errors are typically unavoidable, they could be quite costly for your business if they go unnoticed.

Let’s say someone on the team miskeys an entry during manual invoice capture, showing that you owe a supplier $20,000 instead of $2,000.

Even though this discrepancy would likely get flagged during the invoice audit and never approved (hopefully), your team will still have to expend valuable resources investigating the source of the error.

With automated invoice processing, you can reduce the risk of human error by relying on digital processes, helping to improve the accuracy of your invoice processing system.

How does automated invoice processing work?

From initial receipt to final payment approval, automated invoice processing can help you streamline nearly every step in your workflow.

1. Automated invoice capture

The process begins by optimizing how you receive invoices from vendors, helping you reduce the need for manual collection and data entry.

Your automated solution will be set up with a centralized inbox where vendors can send you invoices.

The appropriate personnel on your accounts payable team will have access to this inbox, though it’s not always owned by just one employee.

If you still receive physical invoices from vendors, these can easily be digitized and uploaded to the shared inbox by taking a photo of it with your phone.

Automated invoice capture is a critical first step that ensures all received invoices are input into the same system so they can be handled uniformly throughout the rest of the process.

2. Automated invoice matching

Next, the invoices in the centralized inbox will be scanned with optical character recognition (OCR) technology, which reads each invoice and enters the data into your system.

During this stage, invoices are checked for accuracy and legitimacy.

The system will either match invoices against a purchase order (for two-way matching) or a purchase order and receipt (for three-way matching).

Your team can review the inputted data and any flags that the system raised, though they no longer have to manually check for such errors on their own.

If your automated invoice processing system is integrated with your accounting software or ERP, invoice data can be synced to your accounts payable and general ledger to eliminate the need for additional data entries.

3. Automated approvals

The automated invoice processing system will then route the invoices to the proper staff members for approval.

Approvers’ responses are also recorded and stored digitally.

Any questions or communications about a specific invoice will be stored within the automated system, giving you visibility into the status of any invoice and a clear audit trail in the future.

If an approver rejects an invoice, this will also be recorded in the system and the payment will not be made.

4. Automated payments

After an invoice has been approved, the automated system supports numerous ways for the payment to be made to vendors.

Your team may have a preference for paying invoices with a card, ACH, wire transfer, or paper check.

Plus, your vendors may have a preferred payment method of their own.

Even if your vendors still only take payment with traditional paper checks, your automated AP solution can print and send checks to your vendors from a clearing account.

5. Automated data storage

Throughout the entire process, data from every stage—from invoice capture to payment processing—is collected and stored within the automated system.

Companies using an automated invoice processing solution get a clear audit trail that makes it easy to access and review previous invoice amounts, payment dates, and approvals as needed.

Manual invoice processing vs automated invoice processing

Many businesses today still use the traditional process of manual invoice processing.

These teams can tap into a number of advantages by making the switch to an automated system and no longer relying on manual data entry.

To give you a better understanding of the benefits of transitioning to an automated invoice processing system, here is a detailed look at some of the biggest differences between the two methods:

3 tips for transitioning to an automated invoice processing system

If you have a smaller business, you may not think it’s necessary to switch to an automated tool to process invoices.

There’s a common misconception that AP automation is primarily for larger enterprise companies. However, that’s not the case.

Automating invoice processing can provide companies of all sizes with meaningful benefits like:

- Better accuracy

- Scalability

- Greater cash flow visibility

- Improved efficiency

In fact, smaller businesses with fewer resources may even find greater efficiencies by using an automated solution, which helps them lower processing costs.

Some automated AP solutions, such as BILL, are built specifically for small and midsize businesses.

If you’re currently processing invoices manually, switching to an automated system will not happen instantaneously.

However, you may be surprised to learn how affordable and easy to set up these solutions can be.

As you prepare for your transition to an automated system, here are some tips and suggestions for a smoother experience:

Select the right solution

Not all automated invoice processing systems will meet your unique business needs.

Make sure to do your research to find a solution that is suitable for your company's:

- Size

- Budget

- Processing capacity needs

- Supported payment methods

Aside from fitting your current needs, look for a program that is flexible and can support your business as you scale and add more vendors.

Ensure data security

While making the transition to any new technology, including an automated invoicing system, you may worry about the potential security risks or data breaches that can occur.

However, you can mitigate these risks by using an automated AP system that has built-in security measures like:

- Two-factor authentication

- Permission-based roles and access

- Clearing accounts to protect your private banking information

- OCR checks for fraud detection

- Digital payments

- Automated workflows for separation of duties

Keep key stakeholders informed

Your team may feel hesitant to embrace the use of automation, especially since nearly a quarter of American workers are reported to be worried that new technologies will make their jobs obsolete.

To keep these fears at bay and ensure successful adoption of the new system, make sure you keep all key stakeholders informed throughout the integration process.

Provide clear expectations of what the program will be used for, and why you decided to transition to an automated system.

You can also have an open discussion about how the new software might change their day-to-day workflows.

Explain that they will spend less hands-on time processing invoices, and point out some of the more engaging and strategic tasks they will have more time for, like vendor relationship management, forecasting, or cash flow management.

Make it clear that you will provide the appropriate training and support to get them caught up to speed on the new program.

Overall, you want to illustrate how an automated system will help their jobs become easier.

Making the transition to an automated invoice processing system is meant to enhance their roles, not replace them.

How to get started with automated invoice processing

Businesses of all sizes can benefit from an automated invoicing system, helping your team save valuable time and money at any scale.

With an AP solution like BILL your team can automate invoice processing, providing you with improved efficiency, billing accuracy, and financial visibility.

Plus, our flexible approval policies allow you to customize the program to fit your unique requirements.

Find out how our invoice processing automation can help streamline your accounts payable workflows.