As a business leader, you need to know if your company is financially on track. The more clarity you have over your financial situation and future sales, the more empowered you are to make intelligent business decisions and reach your goals.

Forecasting is the first step in analyzing business performance.

What is business forecasting?

There are many ways to judge your business’s financial situation, but forecasting is the best one for predicting future events and trends.

Essentially, it involves projecting your business’s future sales, cash flow, expenses, profits, and losses based on trends, patterns, and current and historical data.

Business forecasting allows you to make long-term plans and prepare for market changes. You can tweak your approach to business forecasting based on your business’s unique needs.

What does the business forecasting process involve?

The business forecasting process involves the following:

- collecting primary and secondary sources of data

- analyzing the datasets

- creating strategies for projections

- comparing your forecasting model to the realized outcomes.

You can use your business forecast to create business budgets, allocate funding, make decisions about cash flow and credit needs, and create timelines for new initiatives or acquisitions.

You can use several different forecasting methods to make informed predictions. What works best depends on the circumstances.

For example, a young business with almost no historical data wouldn’t use the same methods as a larger company that has been around for years.

To get the most out of your efforts, you should know why forecasting is important and which approach might be worthwhile for your company.

Why businesses need to practice forecasting

When you use forecasting to predict what the next quarter, year, or decade may look like, you’re generating information that can help you in various ways.

For example, with business forecasting, you can:

- Gain valuable insight: Set smarter goals, make informed business decisions, and create strategies that reflect the insights you gain from forecasted data.

- Decrease costs and increase profits: Stick to an accurate budget based on current market conditions and expected future outcomes.

- Learn from past mistakes: Take control of your business operations by identifying and understanding weaknesses in existing processes.

- Foresee market trends: Better anticipate changes within the market so you can be proactive instead of reactive.

Beyond inter-business benefits, you can also use forecasting to keep customers happy by providing services and products they want and need. This leads to greater brand loyalty and, of course, better profits in the future.

A forecast can also help when applying for loans or new lines of credit since many financial institutions require pro forma financial statements before approving a commercial loan application.

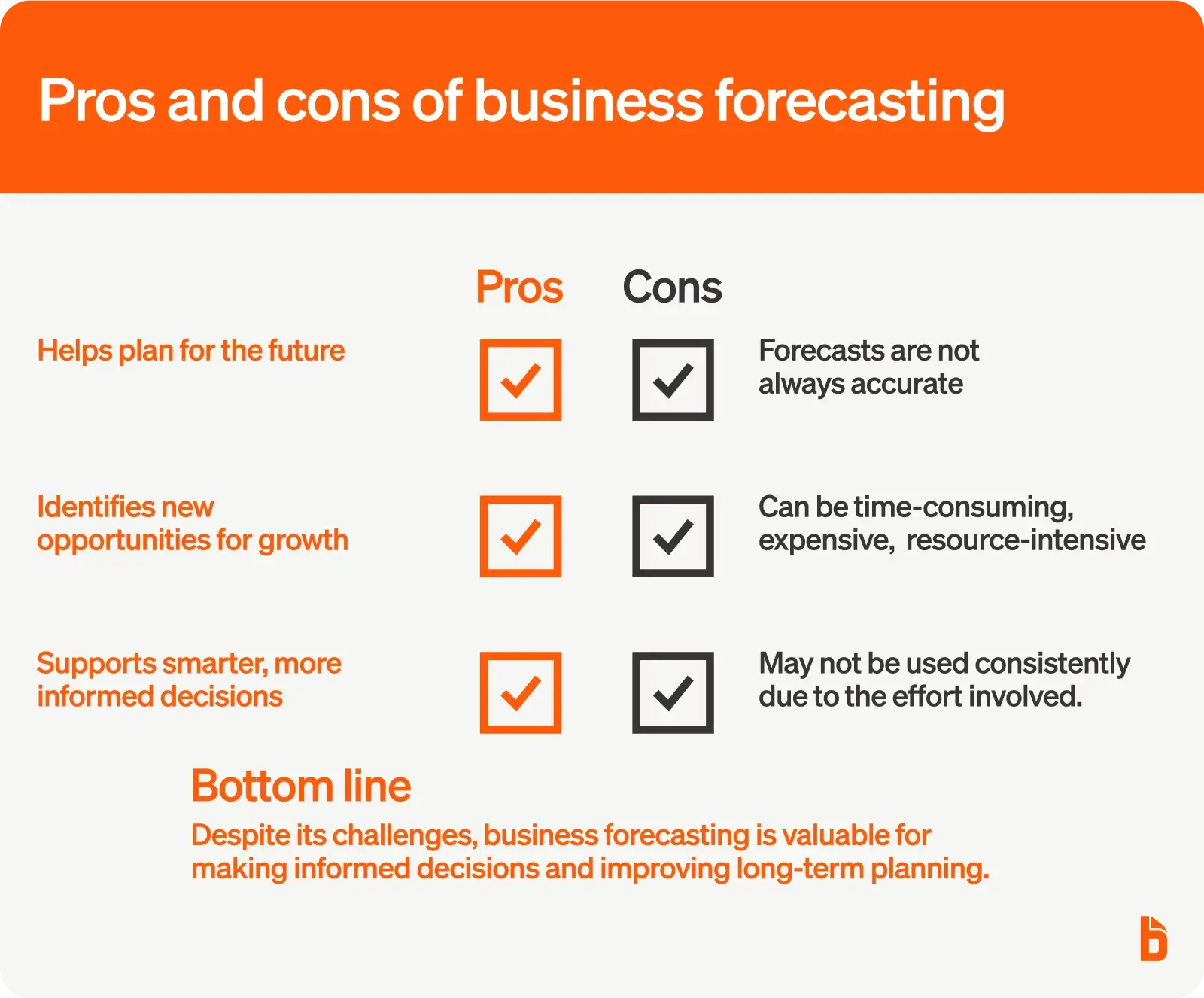

Pros and cons of forecasting

Like any financial strategy, forecasting has upsides and downsides. Here’s a look at both the positives and negatives.

Pros of business forecasting

Business forecasting is meant to predict future trends, events and outcomes for a specific business. This type of analysis can provide valuable insights, including:

- Helping plan for the future

- Identifying new opportunities for growth

- Making smarter, more informed decisions

Cons of business forecasting

Though business forecasting can help you predict future trends, there are some downfalls. These can include:

- Forecasting isn’t always accurate. Forecasting is both an art and a science, so these predictions will never be 100% accurate, even if they’re based on actual numbers.

- Forecasting can be time-consuming, expensive, and resource-intensive. Because you’re striving for accuracy, collecting and analyzing data can be time-consuming, expensive, and resource-intensive. That’s why many companies don’t use forecasting as regularly or consistently as they should.

Despite these potential downsides, the results that come from committing to forecasting are usually worth the effort because you can gain clarity or even debunk some of the assumptions holding you back from realizing greater profits.

The bottom line is that predicting future trends and events enables informed business decisions.

Business forecasting examples

There are two types of data you can use in your forecasting methods: market surveys and formulas and analysis of past and present data.

When you don’t have enough past data to create a prediction, you can instead conduct market research through surveys, focus groups, polling, and observation. This can be useful if you have a young company and want to know which products or services your target customers favor.

When you have enough past data, you can use this data to make accurate estimations. For example, with years of recorded data, you can safely estimate the sales you’ll make in the next fiscal period by analyzing the previous years’ sales trends.

Types of business forecasts

There are many ways to estimate data and scenarios for your company. Each type of business forecast focuses on a specific metric or outcome. What you want to know or predict about the future will help you decide which type of forecast you pursue.

Business forecasts can range from the general (sales next month) to the incredibly specific (consumer demand for a specific product for the holiday season). Here is a quick rundown of the 6 most common types of business forecasts.

1. General business forecasting

You use a general business forecast to determine the overall business climate for a future date. You can use this type of forecast in many different businesses and industries.

Used for: Determining overall market conditions and the impact of the environmental factors in which your business operates

Best for: Businesses operating in influential environments, such as countries experiencing political upheavals, major technological advancements, or dramatic seasonal shifts.

Example: Analyzing the impact the next U.S. Presidential election will have on the American economy at large.

2. Financial forecasting

Financial forecasting is about getting a clear picture of where your company is headed. It includes analyzing assets and liabilities, accounts payable and accounts receivable, operating costs, capital structure, cash flow, and general market conditions.

Used for: Tracking the future trajectory of your company as a whole.

Best for: All businesses looking to stay on top of their business’s health through financial projections.

Example: Using past financial data and market trends to estimate future cash flows.

3. Accounting forecast

An accounting forecast is about predicting your company’s future costs using past and present data to estimate how much you will pay for raw materials, inventory, man hours, utilities and rent, insurance, and more.

Used for: Determining future operating costs for your business.

Best for: Every business concerned with covering future costs.

Example: Estimating cyclical changes in a seasonal product’s cost, such as fresh produce for a restaurant.

4. Demand forecasting

Your demand forecast goes hand in hand with a sales forecast, as demand forecasts predict what the market needs or wants, while a sales forecast predicts how your business capitalize on those needs with sales.

Used for: Determining future market and customer demand for a good or service.

Best for: Planning how much to invest in raw materials or inventory or deciding if a new product will perform well.

Example: Predicting the demand for a new toy at Christmas so you can buy the appropriate inventory.

5. Sales forecasting

A sales forecast estimates future sales based on sales data. The forecast may look at your sales as a whole or a specific product or service within your business offerings. Sales forecasting allows you to anticipate the future needs for your workforce, resources, cash flow, inventory, and investment capital. A sales forecast shows the sales revenue you might expect over the next month, quarter, or year of a sales cycle.

Used for: Predicting your sales for a future period and estimating growth and cash flow.

Best for: Businesses relying solely on sales history or looking to project sales for investors and funding.

Example: Projecting revenue for the next fiscal year to determine how many salespeople to hire and their commission structure.

6. Capital forecasting

A capital forecast is based on current and future assets and liabilities, as well as predictions for liquid capital and cash flow estimates.

Capital forecasting is tricky, and not as reliable as other forecasts simply because it involves guessing at a number of factors. Capital may involve the following factors:

- Cash & savings

- Assets

- Accounts receivable

- Revenue

- Investment funding

- Lines of credit

Used for: Predicting available capital for a future date or event.

Best for: Companies preparing for investment, growth, hiring, acquisitions, or other changes that require cash.

Example: Estimating working capital for purchasing a larger office building in the coming year.

Forecasting methods vs. forecasting types

A forecasting type identifies the target you’re pursuing (sales, cash flow, etc.).

A forecasting method is how you gather and identify data (qualitative vs. quantitative).

The forecasting method is the tool you use to gather and evaluate relevant data for your forecast type. Within each of these forecasting techniques, you’ll use different recipes or methods of forecasting to create the data you need.

Two common approaches to forecasting methods

While there are several forecasting techniques, they all fall within two general categories: quantitative and qualitative. Depending on your data and the age of your business, one approach will be more beneficial than the other.

Quantitative forecasting focuses on structured data, statistical analysis, and experiments, while qualitative forecasting uses unstructured data since it relies on interviews, surveys, and observations.

Diving into the details of both methods, let’s consider why you might use one over another, the most frequently used sub-methods, and the types of insights each methodology offers.

#1: Quantitative forecasting methods

What is quantitative forecasting? As its name implies, quantitative forecasting is all about numbers and measurable data. These forecasting models focus on existing data, numbers, and formulas without much unstructured human input. The analysis is statistical, the outcomes are conclusive, and the patterns observed provide a straightforward course of action. When you discover (or suspect) cause-effect relationships, you can leverage the variables for maximum benefit.

Quantitative forecasting helps you answer questions like “how many” and “how often,” which are helpful when adding new services or products or adjusting existing ones. It’s also beneficial for predicting sales figures from one year to the next.

You might use quantitative forecasting to uncover answers to questions like:

- How steady is our demand?

- Is there a market for our products and services?

- What is our primary demographic? What are their buying habits?

- How are the needs of our target market changing?

- What will our sales look like this January?

Quantitative forecasting models are ideal for businesses with at least three years’ worth of past data. You’ll want at least three years so you can determine probable results. From here, you can accurately analyze data patterns and predict trends.

Some of the most frequently used quantitative business methods are time-series and causal.

Time-series

The time-series method is the most common quantitative approach to forecasting. It focuses on making predictions based on factual information.

Using current and historical data, researchers can build data models that help business leaders understand the “why” behind the business’s experiences. Forecasting then helps predict the future based on this information.

Within the time-series method are two standard models:

- Exponential Smoothing (EA): Exponential smoothing is frequently used to give decreased priority (“weight”) to older observations while giving more weight to recent observations.

- Moving Average (MA): Moving average is the simplest and most straightforward way to forecast. You base the analysis on the average calculations from a previous period. That average value becomes the forecasted value for the next period.

What is the business forecasting process?

Time-series techniques are statistical, so you need several years’ worth of data where relationships and trends are clear and stable.

Why would you use this method?

This method is standard in finance, retail, and business forecasting. You may use it to forecast your daily product sales or better understand seasonal changes, such as how your sales change between the winter and spring months.

How accurate is this method?

With the time-series approach, the quality of the results depends on the method you choose to work with and how long you plan to forecast. Generally speaking, the shorter your time period, the more precise your time series forecast will be. An ideal timeline is three to six months.

Causal forecasting

The causal method studies the relationship between two variables while assuming that one variable affects the other. In other words, two (or more) variables need to have a cause-effect relationship.

In general, the dependent variable represents the prediction. An example is the sales growth of certain products. The independent variable might describe the issue or point of interest. A short-staffed warehouse crew is an example of an independent variable.

The causal model then asks: How will being short-staffed affect the future sales of our products?

The diagram below shows the relationship between work perceptions, customer loyalty, employee retention, and financial performance.

Within causal forecasting is a method called regression analysis, which uses statistical equations to estimate the impact of those variables. Researchers might want to know how the predictors (independent variables) impact the outcome (dependent variable).

In business, causal forecasting can measure anything from the relationship between sales and distribution to the link between employee productivity and pay raises.

What is the business forecasting process?

When using causal forecasting for business purposes, plan to have at least two years of existing data to work with. Since companies commonly use this method to predict sales, labor costs, or future challenges, you need past data to start your linear line. With causal forecasting, you should forecast for a few months to a year for accuracy.

Why would you use the causal method?

The causal method is helpful when you need to analyze current and future trends and make estimates related to everyday operations like distribution, scheduling, or manufacturing.

It’s also an ideal approach when you’re looking to develop your sales or marketing techniques. This is because it helps you understand if there is a correlation between two variables so you can determine if something is worth pursuing or fixing.

How accurate is this method?

Ultimately, causal methods should determine the impact variables have on one another and how that will affect day-to-day operations or consumer demand. The data undergoes constant adjustments and revisions, and you need to ensure you’re including the latest information. These features are also why causal models continue to be an accurate method for predictions.

#2: Qualitative forecasting methods

Qualitative forecasting aims to gain a qualitative understanding of a given subject, problem, or point of interest. Instead of numbers and formulas, qualitative forecasting focuses on human feedback from experts and customers.

It is an unstructured, broad, non-statistical approach with subjective interpretations. The outcome of these forecasts helps you develop a deeper understanding of a previously posed question.

For example, if you want to know your customers’ thoughts about a new product, you can use qualitative research to measure their opinions.

This approach is best for businesses that don’t have enough raw data to reach an accurate quantitative forecast. It’s also helpful for companies that don’t need numbers to lead them in the right direction but want to know what brings the most value to their customers.

In qualitative forecasting, leaders may ask questions like:

- Why do you think this product is or isn’t better than competitor products?

- What would you do to improve this new service?

- How would you describe this website design?

- What does this advertisement say to you?

Under the umbrella of qualitative forecasting, there are useful techniques, like market survey research, the Delphi method, and the panel method.

Market research

Market research is a systematic procedure that focuses on testing hypotheses about real markets. You can conduct market research through personal interviews, observations, field trials, and focus groups.

.png)

Basically, market survey research involves asking a targeted group of people questions to gain insight into a particular issue or data point. Once you collect the responses, you convert the data into numerical results.

To be clear, there is a level of numerical analysis involved in qualitative research—you can always focus on a subsection of responders as a statistic. You can also code their responses in predetermined categories and calculate how many respondents fall within a given group. However, qualitative data is human-led and involves human interfacing in ways that quantitative data does not.

Qualitative forecasting can help you better understand consumer needs, evaluate competitors, and identify market trends quickly.

Researchers use two types of surveys to collect data:

- Cross-sectional surveys are observational surveys conducted on a targeted population. This is most commonly used in the retail and healthcare industries.

- Longitudinal surveys are conducted across various time durations to study behavior and thought process changes. These behavior changes could take months, years, or even decades to measure.

So, for example, if a clothing store owner wants to become more familiar with current fashion trends, they may use a cross-sectional survey on their most common shopping demographic.

On the other hand, if an electronics store owner wants to observe the buying habits of middle-aged couples, they may use a longitudinal survey over the span of 10 years.

What is the business forecasting process?

Market research methods typically take at least three months, although you can achieve greater accuracy if the process takes longer. You should collect data from a wide variety of sources, including questionnaires, interviews, surveys, and polling.

Why would you use this method?

Retailers and the healthcare industry often use market research to observe customer satisfaction and receive feedback on new products or services.

How accurate is market research?

Nearly 75% of respondents from a survey about the accuracy of market research say this methodology is “less than or not very accurate”—but data, rather than people’s perceptions, confirms the opposite.

Research compiled by Harvard Business Review found that market research can produce very good to excellent results when working with the correct timeline—and the right method for graphing, mapping, and spotting trends in the data.

The Delphi method

The Delphi method involves asking a panel of experts a set of questions. This process is flexible and ever-changing since the responses to one questionnaire determine the next round of questions.

This process is used to reach a consensus on a subject, but the experts can share and change their answers depending on how they interpret the other responses.

You can repeat the questionnaire rounds several times until there is a consensus. Once you reach a consensus, the final result is considered a true reflection of the group’s opinion.

Why would you use this method?

The Delphi method is ideal for businesses whose market research is limited. When a company wants an accurate forecast for their specific industry, they might decide to survey experts to come to a precise conclusion.

So, for example, a business specializing in dog grooming may request a panel of experts already familiar with the pet care field to gain insight into a new service or product. These experts have experience with common trends and patterns found in the pet care industry, so their opinions are an important resource.

What is the business forecasting process?

For the Delphi method, a researcher issues several questionnaires, and the process should take at least two months. The coordinator manages the questionnaires and consolidates and edits responses so they’re ready for analysis.

How accurate is the Delphi method?

While time-consuming, the Delphi method is one of the most accurate business forecasting methods because it can forecast future trends with between 96 to 97% accuracy.

Panel consensus

The panel method assumes several people can arrive at a worthwhile consensus. The process involves interviewing the same group of people on two or more occasions to understand how behaviors or attitudes change through repeated interviews.

The panel technique might be useful with focus groups, group surveys, or personal interviews.

However, sometimes businesses will conduct a company-wide meeting with internal members and industry experts who can openly discuss a product or service that the company plans to offer. Everybody is encouraged to share thoughts and opinions until the group reaches a consensus.

Why would you use this method?

You might use the panel consensus method to compile many ideas and see which ones are the most widespread or valuable. For example, if you want to know what changes might improve employee morale, gather a selected team of panelists to share their opinions and thoughts.

What is the business forecasting process?

You should measure results from the panel consensus method for at least two weeks to produce at least two data reports over time.

How accurate is this method?

Panel consensus forecasts are not usually very accurate. Sometimes, the experts are influenced by social factors, like groupthink. When this happens, you won’t get a true consensus. It’s also worth mentioning that it can be challenging to track and analyze several responses that don’t seem relevant to one another.

Get started on your business forecast

Now that you’re familiar with different forecasting approaches, how do you know which method suits your business? As you might have predicted, there is no simple answer.

“When firms ask, what’s the best forecasting technique? The answer is, it depends. Businesses don’t like to hear that, but it does depend,” explains Barry Keating, a Notre Dame professor of Business Economics & Predictive Analytics.

“It depends on how much data you have, on what you’ve done in the past, and it depends on the kind of thing you’re forecasting and its importance.”

But there is good news. Taking the first step to understanding what business forecasting methods are best is easy. Begin by asking a set of questions, and then use your answers to guide you in your decision. These questions are a great jumping point.

- What is the problem or data point that you want to focus on?

The more specific your problem or data point, the better you can hone in on the correct method.

For example, if you’re launching a new service, you can use qualitative approaches to survey customers and experts. Then you can find out whether or not the service will positively impact your business. Or, if you’re curious about whether employee bonuses affect morale, you could use a long-term quantitative approach.

- Do you have historical data available?

One of the most critical steps in choosing a method is evaluating how much data you have.

Quantitative forecasting requires at least three years of historical data to produce an accurate prediction. If you don’t have relevant data, you might want to use qualitative business forecasting methods instead.

For example, if you want to determine your winter sales totals, you can use historical data to predict this year’s numbers. But if you want to focus on a new product or service, try a qualitative method.

- How far into the future do you want to forecast?

The market constantly changes, so you have to think carefully about how far into the future you want to forecast.

Short-term forecasts typically cover a few months and are best left for quantitative methods, which use existing company data.

Long-term forecasts, which can exceed a year, should reveal some trend or pattern changes, which is why these are better left in the hands of experts. They’re also useful when learning about your target demographic using qualitative methods.

- Do you have the time and resources to make this forecast?

Forecasting is a broad term, and business forecasting methods come in all shapes and sizes. Some techniques require a formula in an Excel spreadsheet, while others require months-long surveys, polls, and focus groups.

Some approaches are more time-intensive and expensive than others, so set a timeline and budget for resources (time, money, expertise) once you determine the metric or question you need to explore.

Make accurate predictions with business forecasting software

Whether you want to stick to formulaic forecasts or conduct a broader outreach with qualitative forecasting, you need somewhere to store, track, and analyze your data and results with ease.

Since forecasting is a mixture of business intelligence and data science, it’s easy to get lost or a little off-track if you’re inexperienced.

It may seem like forecasting is a lot of work for an unpredictable, possibly nonexistent payout. But there are several solid reasons that you should regularly use forecasting in your business.

Benefits of business forecasting:

- A better grasp of in-house data and business performance

- Competitive advantage

- Setting and enforcing effective budgets

- Faster response to cyclical or seasonal changes

- Ability to identify larger patterns and relationships

- To assist in long-term strategy and goal-setting

Forecasting isn’t perfect, but it is a useful tool and practice for understanding your company’s financial state and remaining agile in a changing market. At the very least, forecasting helps you know your own company and gather your own data—making you a smarter and better-informed business owner.