Days cash on hand (DCOH) is a standard financial metric used by businesses and investors to assess the liquidity and financial health of a company.

It represents the number of days a business can continue to cover operating expenses using its cash on hand without any additional influx of funds or revenue.

This ratio is essential for businesses, as it helps them identify potential cash flow issues and gauge their ability to sustain operations during difficult financial periods.

The DCOH formula requires two key components: cash on hand and average daily operating expenses.

Cash on hand represents the company's current cash reserve, while the average daily expenses can be calculated by subtracting non-cash expenses, such as depreciation, from the annual operating expenses and dividing the result by 365 days.

By dividing cash on hand by the average daily operating expenses, we can determine the number of days the company can sustain itself using cash reserves alone.

Understanding days cash on hand formula

DCOH is a financial metric that calculates the number of days a company can sustain its operations with the cash it currently has available.

This ratio helps investors, creditors, and management understand a company's liquidity and ability to meet short-term financial obligations.

Maintaining sufficient cash reserves is crucial for a firm's stability, especially during unforeseen challenges or economic downturns.

The formula for calculating days cash on hand is:

Days Cash on Hand = Cash on Hand ÷ [(Annual Operating Expenses - Non-Cash Items) ÷ 365 Days]

Where:

- Cash on hand represents the amount of liquid assets a company possesses at a given time. This includes cash and cash equivalents, typically found on the balance sheet.

- Annual operating expenses refer to the total costs incurred by a company to carry out its day-to-day operations, such as salaries, rent, and utilities. This information can be found on an income statement.

- Non-cash items include expenses like depreciation and amortization, which do not directly impact the company's cash flow.

To calculate DCOH, subtract the non-cash items from the annual expenses and divide the result by 365 days. This gives the average daily cash outflow for the company. Finally, divide the cash on hand by this daily outflow to find the days cash on hand.

It's worth noting that different industries have varying working capital needs, so the ideal days cash on hand ratio may vary from one sector to another.

Comparing the days cash on hand ratios of companies within the same industry can provide valuable insight into how efficiently they manage their cash resources.

Key components of the formula

To calculate a business' DCOH, it is crucial to understand its key components:

- Operating expenses

- Cash or cash equivalents

Operating expenses

Operating expenses refer to a company's daily costs while running its business operations. These costs can include employee salaries, rent, utilities, marketing, and other expenses required to keep the business running smoothly.

It is crucial to document all such expenses within the formula, as this accurately represents a company's ability to meet these costs with its cash on hand.

However, while calculating days cash on hand, non-cash items (such as depreciation or amortization) should be excluded from total operating expenses, as they do not impact the company's cash position.

Cash or cash equivalents

Cash or cash equivalents are the most liquid assets held by a company.

Cash includes physical currency and deposits held in banks, including short-term investments that are readily convertible to cash with a known market price and three months or less maturity period.

Cash equivalents include treasury bills, commercial paper, or money market funds.

A company's liquidity position is strongly influenced by its cash and cash equivalents, which cover operating expenses and fulfill financial obligations.

Therefore, utilizing the formula enables businesses to measure their financial health and ability to continue efficiently covering operating expenses over a certain period with their available cash.

How to calculate days cash on hand ratio

Calculating the days cash on hand ratio is essential for businesses, as it helps determine the company's ability to cover daily operating expenses using its available cash.

The formula for calculating this ratio is relatively straightforward and can be broken down into a few manageable steps.

- Identify the cash on hand, which can be found on the company's balance sheet as cash and cash equivalents.

- Determine the annual operating expenses by looking at the income statement and summing up items that fall under the operating expenses category.

- Identify any non-cash expenses like depreciation and amortization, also found in the income statement typically at the bottom of the income statement under the other expenses category.

- Calculate the cash outflow per day by subtracting non-cash expenses from annual operating expenses and dividing the result by 365 days: (Annual Operating Expenses - Non-cash Expenses) ÷ 365.

- Finally, divide the cash on hand by the outflow per day to find the days cash on hand ratio: Cash on Hand ÷ (Cash Outflow per Day).

Example

Consider a hypothetical company with the following financial data:

- Cash on hand: $400,000

- Annual operating expenses: $1,500,000

- Depreciation and amortization (non-cash expenses): $80,000

First, calculate the cash outflow per day:

(Annual Operating Expenses - Non-cash Expenses) ÷ 365 = ($1,500,000 - $80,000) ÷ 365 = $1,420,000 ÷ 365 = $3,890.41

Next, divide the cash on hand by the outflow per day to find the days cash on hand ratio:

Cash on Hand ÷ (Cash Outflow per Day) = $400,000 ÷ $3,890.41 = 102.82 days

In this example, the company has a days cash on hand ratio of 102.82 days, meaning it can cover its daily operating expenses using its available cash for approximately 102 days.

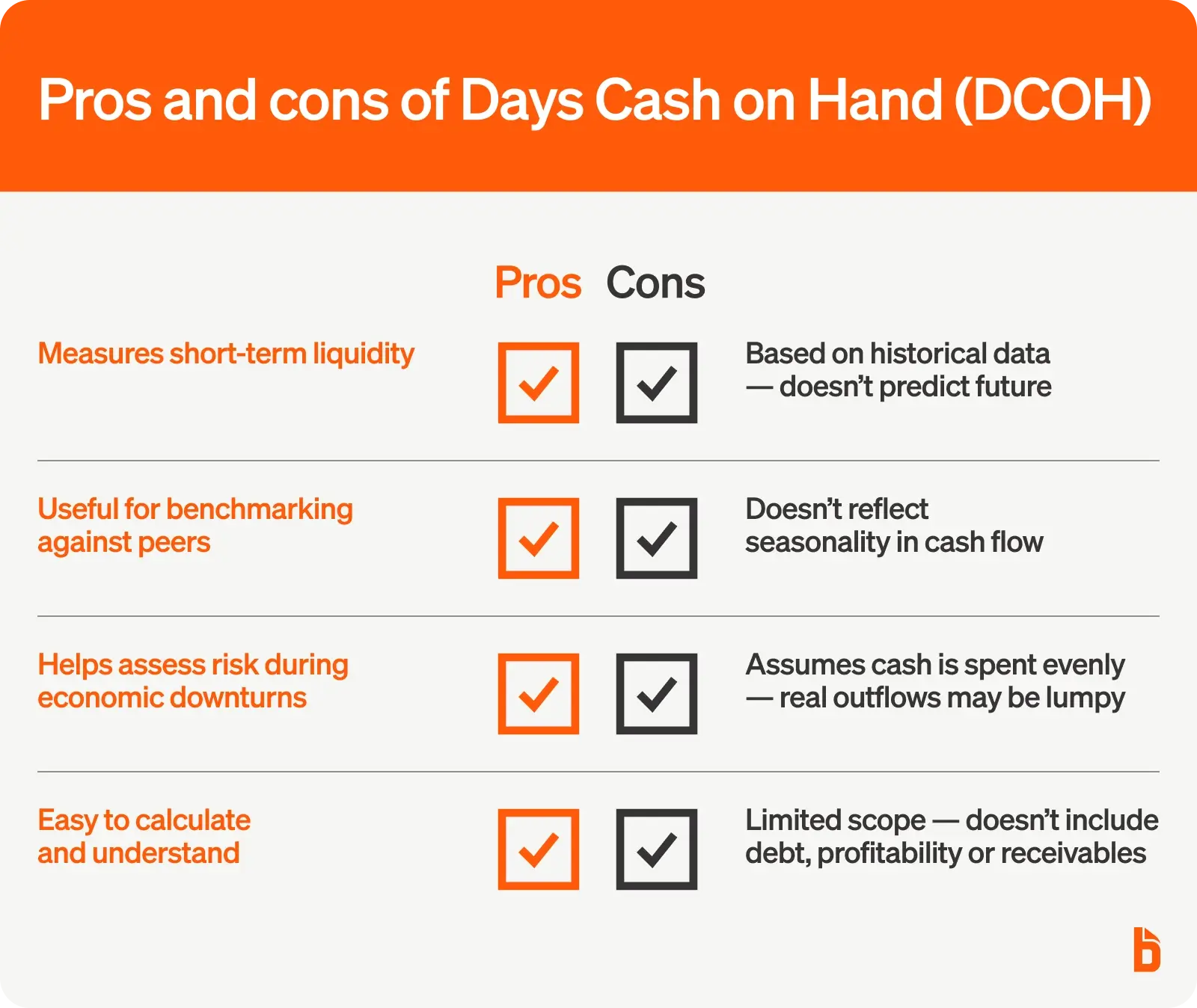

Pros and cons of the days cash on hand formula

Pros

DCOH is a valuable financial ratio for assessing a company's liquidity.

It showcases how long a company can continue operating using its available cash to cover operating expenses without additional cash coming in.

This metric has several benefits:

- Liquidity monitoring: DCOH helps managers and investors measure the company's short-term financial health by indicating available cash to cover operating expenses.

- Comparative analysis: Companies can compare DCOH ratios with their competitors or industry standards to gauge their performance and financial stability.

- Risk assessment: A higher DCOH ratio signifies lower risk since the company has more cash available to meet its immediate obligations, thereby immediate avoiding cash flow issues.

Cons

Despite its benefits, DCOH has certain limitations:

- Cash-flow fluctuation: DCOH relies on historical data and does not account for future cash-flow fluctuations. As a result, it may not accurately reflect the company's future liquidity position.

- Seasonal variation: Companies with seasonal businesses may have varying DCOH ratios throughout the year, making it challenging to draw accurate conclusions based on a single data point.

- Based on an average daily cash outflow: The formula for calculating DCOH is based on cash going out daily but that is likely not the case for most businesses. Cash tends to be spent in a lumpy manner meaning some days a business will not spend any cash and others they will spend a lot. For example, rent and payroll might be due on the 1st of every month but then they might not spend any money for several days afterwards. This can cause the days cash on hand formula to be inaccurate depending on the timing of expenses and cash going out.

- Limited scope: DCOH does not provide a complete picture of a company's financial health, as it only considers cash and operating expenses without considering other factors, such as leverage and profitability. It should be used in conjunction with other ratios for a comprehensive analysis.

Days cash on hand is a useful financial ratio for assessing a company's liquidity, particularly in the short term.

While it offers insights into a company's ability to meet its immediate obligations, it has limitations that should be considered when drawing conclusions about its overall financial health.

Track cash on hand with BILL

With BILL’s accounts payable and accounts receivable platform, a business will be able to effortlessly manage invoices, payments, and receivables, reducing the time it takes to convert your outstanding balances into available cash.

Our intuitive interface and automation features eliminate manual tasks and reduce the risk of errors, ensuring that your financial operations are seamless and efficient.