When employees pay for business expenses out of pocket, you can use expense reports to document those costs for tax time and to manage reimbursements. Expense reports also help business owners and department managers see how much they’re spending in general.

What is an expense report?

An expense report is a document that lists specific business expenses and the details related to each one, such as the amount, date, and purpose of each expense. As a business activity, expense reporting helps track the costs of different departments, manage out-of-pocket expenses such as office supplies or business trips, and monitor different expense categories.

Key elements of an employee expense report

For a business to claim tax deductions for reimbursements, the expense reporting process must follow certain Internal Revenue Service guidelines. These guidelines are designed to make sure expense reimbursements are for business-related expenses (not personal expenses), actual expenses (with documentation to prove it), and accounted for in a timely manner.

Employees must create expense reports according to these guidelines and submit expense reports to the finance team within a reasonable amount of time. Each expense report should include the following employee business expense data and other items.

Employee information

Your expense reporting software should automatically capture the employee making the reimbursement request. If you're using a manual process, such as a spreadsheet, the employee will need to start by filling out key identifying information such as their name as well as the name of their manager.

Date of expense

Expense reports are often filled out days or even weeks after the fact, especially in the case of business travel expense reports. Your expense tracking software or expense tracker template needs to capture the date of the reported expenses, making sure the reimbursement request falls within the company's expense policy limits.

Vendor

When employees incur business expenses, they can make business purchases from virtually anywhere. The vendor's name should be included, but this may not be enough to identify the business purpose behind the expense being claimed.

Expense category

Businesses require employees to state the category for reimbursable expenses so they can input the expense correctly in their accounting software.

Description

Many business expenses aren't immediately obvious from the vendor's name and category alone. The approval process needs to require enough of a description to show how the expense is ordinary and necessary to business operations.

Purchase cost

Cost should be included for each individual expense, even when a single report contains multiple expenses, such as a flight, hotel bill, and car rental.

Supporting documentation

The employee should upload receipts for each individual expense incurred.

Subtotals by category

Total expenses should be summed by category, helping the accounting team double-check their own category entries.

Grand total

Finally, the expense report should include the grand total of all expenses covered by the report.

Approval

The accounting or finance team needs to approve expenses before reimbursement. This includes verifying expected expenses with managers, verifying that receipts match claimed expenses, and verifying that each line item as well as the total is within the company's expense policy.

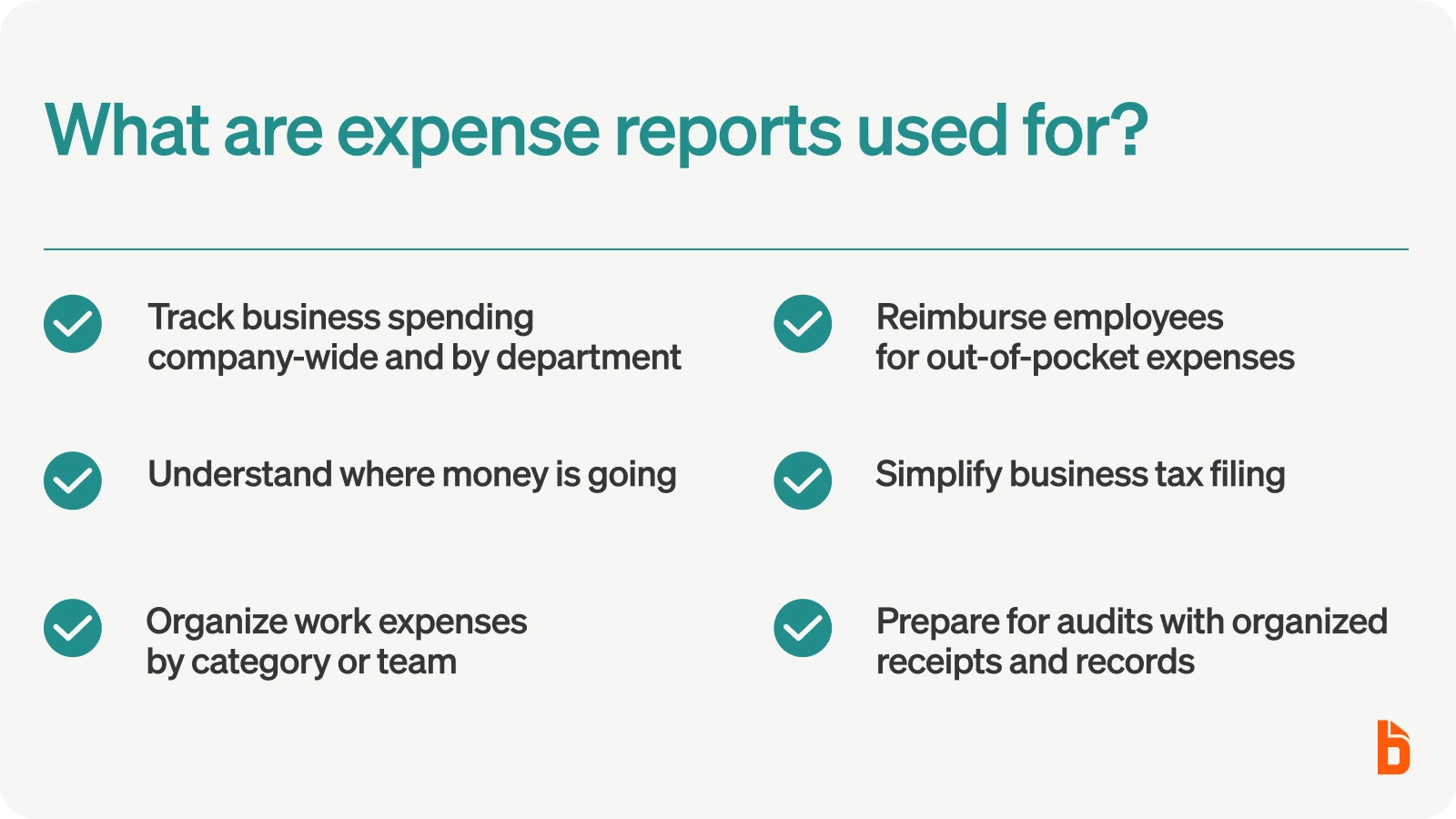

What are expense reports used for?

You can use expense reporting to track business spending both company-wide and by department. Expense reporting helps business owners:

- Understand where money is going

- Organize work expenses by department

- Reimburse employees for expenses they paid for with their own money

- File a business tax return with ease

- Prepare for any future business audits with receipts appended

Your business budgets already include expenses, of course, but expense reporting helps ensure that you’re accurately reimbursing employees as well as organizing your tax-deductible business expenses for tax season.

If you’re using expense reporting to help you prepare your taxes, just remember that not all business expenses are deductible. Using the IRS categorizations of tax-deductible and non-deductible expenses will help immensely as you prepare to file your business taxes.

Expense reporting can include any of the usual types of expenses:

- Fixed: Fixed expenses remain the same and don’t typically change. Examples are debt payments, lease payments, insurance, and subscriptions.

- Variable: Variable expenses differ each month. Examples include packaging, advertising, utilities, and hourly labor.

- Periodic: Periodic expenses might occur quarterly or annually, such as payments to an external accounting firm for tax filing. Periodic expenses may also be unforeseen or expected, like emergency repairs, or could include annual bonuses.

To track money going in and out, business entities might generate expense reports monthly, quarterly, annually, or anytime between.

The information included in expense reports can impact your financial statements by subtracting from your business’s revenue in a given fiscal period and reducing the profit reported on your income statements. However, expense reports are not official financial statements and don’t show up in a company’s filings.

What are the different types of expense reports?

In the world of expense reporting, there are several templates you can choose from to record and itemize your business’s expenses properly.

Of course, the type of expense report template you should work with will depend on the type of expenses you’re tracking. For example, agencies and consultants will use expense reports to track expenses with a specific client. In contrast, sales representatives may use them to get reimbursed for travel and accommodation costs.

While there is an expense report form for almost any occasion, the most common three are one-time, recurring, and long-term expense reports.

One-time expenses

A one-time expense is a non-recurring cost that happens infrequently. It could be regarded as a type of variable expense.

These forms are commonly used when employees make out-of-pocket business expenses. One-time ordinary expenditures include:

- Relocation costs

- Event costs

- Meal/accommodation/travel costs

- Sale of an asset

As shown above, one-time expense reports are short and straightforward. All you need is the expense, pay period, description, and a signature signing off on the total cost.

Recurring expenses

A recurring expense is a type of ongoing cost. These expenses commonly appear in an annual, quarterly, or monthly expense report. However, recurring expenses are standard costs that you expect, such as:

- Rent

- Insurance

- Salaries

- Debts

- Administrative costs

A recurring expense report form allows an employee or manager to document various expenses line by line. Every item that is regularly itemized (that is, any recurring item) should have its own column on this type of report.

Long-term expenses

A long-term expense occurs on occasion. It could be considered a type of periodic expense. Some standard long-term costs are:

- Repairs

- Maintenance

- Occasional trips

- Holiday gifts or bonuses

A long-term expense report is helpful because it allows account managers to get an idea of the kind of spending associated with a specific part of the business over time.

When comparing long-term expense reports to other templates, you’ll see that each month gets its row, and then monthly totals must be calculated for each expense category.

As shown above, one-time expense reports are short and straightforward. All you need is the expense, pay period, description, and a signature signing off on the total cost.

A long-term expense report is helpful because it allows account managers to get an idea of the kind of spending associated with a specific part of the business over time.

When comparing long-term expense reports to other templates, you’ll see that each month gets its row, and then monthly totals must be calculated for each expense category.

Expense report template

While there are many different types of expense report forms, almost all require the same basic set of information to make tracking, organizing, and filing as seamless as possible. Here are some of the fundamentals you might include in your expense reports for reimbursements:

- Company information. This includes the employee name, the manager name, the employee ID number (if applicable), and the name of the department where the expense occurred.

- Timeline and dates. The expense report needs to have the date on which an expenditure occurred (so it should match the date on the attached receipt if there is one). There will also be the date that the expense report is completed and submitted.

- Purpose of the expenditure. Whether it’s employee reimbursement or a run-of-the-mill insurance payment, the expense report needs to include the nature of the expense as well as the description.

- Cost of the expenditure. A separate column will display the cost of all the expenses and total them at the bottom.

- Category or department of the expense. Depending on how the business operates, the expense report might require a specific account that the payment is charged to or state the expense category. Smaller companies may organize by category since they may not have separate departments.

- Payment information. This section asks how (what check number, credit card, or account?) and when (the date) someone made the expense.

- Signature. No matter who submits an expense report, a certified signer’s final signature verifies that they have reviewed the report.

Expense report example

Consider this example of an expense report for travel-related expenses below. This common business expense report makes it easy to break down all the costs involved.

How to create an expense report

Preparing and submitting an expense report is easy—you simply need to ensure your numbers are accurate by tracking expenses and attaching necessary receipts.

Once completed, a manager will submit the expense report to the higher-ups or the finance department. Some businesses let approved employees submit a report as long as it’s been verified and endorsed by a manager.

Here’s a quick step-by-step process on how to fill out an expense report:

1. Choose an expense report template

Based on the timeline of expenses you’re going to report, choose a relevant report template.

So, for example, if one of your employees needs reimbursement for a sales trip, you would use a one-time expense report. (Unless your employees do travel a lot—then a recurring expense report with rows for each month or quarter might be better.)

Follow the information on your template by filling out all necessary details, like the date, company, employee name, and whatever else the top part of the report may ask for.

Repeatedly filling out expense reports can get tedious, which is why many small businesses ditch the free templates that are available online. Instead, you can choose automated expense reporting software that fills in all of your company’s information and provides customized templates that match your exact needs.

2. Add your itemized expenses

In the itemized section, list all of the relevant expenses that meet the criteria of your expense report. Employees who travel for work might include gas mileage, hotels, and meals on their expense report.

Employees that need to get reimbursed should include receipts for all purchases but especially under these conditions:

- If the expense is over $75 and the nature of the expense is not apparent on the electronic receipt.

- For lodging invoices where the credit card company does not provide the merchant’s electronic itemization of each expense.

- If an employee pays for an expense without using the business credit card.

Expenses should be placed in chronological order so that the most recent transaction is the last line.

3. Add up the total

When you’ve listed all of your business expenses incurred, add the amount of each expense to generate a single total.

If you’re listing different categories—such as a recurring expense report that has rent, utilities, and salaries—then you’ll add together the grand total of all the expenses from each category. This final number tells you your business costs in that department or for a particular time period.

As an expense management activity, this final number can also help inform your budget, which is itself a road map you create for your business. Expense tracking and reporting allow you to observe your budget in action.

Take advantage of automated expense reporting with BILL Spend & Expense

The most complicated thing about expense reports is finding the right template for the type of expenses you want to itemize. But using an expense reporting solution customized to your business’s needs makes that process easy.

Expense management software can help you keep track of employee spending and review transactions in real time, so nothing is ever a surprise. And, you won’t have to spend valuable time worrying whether your expense reports are in order. Learn how BILL Spend and Expense can help you save hours every month on expense management.