As businesses and consumers are seeking more convenient and efficient ways to manage their finances, online bill pay services have gained popularity in recent years.

Online bill pay enables businesses and consumers the ability to securely pay bills and invoices digitally without the need for traditional paper processes.

This piece will explore the benefits of online bill pay services, why companies and customers are widely adopting this form of payment and best practices to ensure a successful online bill pay experience.

How does online bill pay work?

Online bill pay is a digital service that allows businesses to offer customers the option to pay their bill online. Customers can make payments directly from their bank account, credit card, or other payment method to the business using online bill pay.

Online bill pay often allows customers to have the option of setting up automated payments to ensure payments don’t go overdue and they don’t incur penalties.

Benefits of online bill pay services

There are many benefits to utilizing online bill pay for your company. These include:

- Cost savings: Electronic billing and online bill pay can reduce the costs associated with paper-based billing and payment processing.

- Increases efficiency: Online bill pay as a payment method can reduce errors, streamline record-keeping and improve overall efficiency.

- Better cash-flow management: Companies who adopt online bill pay gain increased visibility and control over cash flow in order to track invoices and manage their accounts receivable more efficiently.

- Better customer experience: Online bill pay provides customers with flexibility when it comes to payments that could lead to increased satisfaction with the business.

- Enhanced security and fraud prevention: Customers are provided with increased security measures like multi-factor authentication, secure login, and encrypted transactions.

- Environmental friendliness: Online bill pay helps reduce waste by eliminating paper invoices and bills and reduces energy usage.

Drawbacks to online bill pay

While online bill pay has increased in popularity and has been widely adopted by companies, there are still important factors to consider before choosing to provide this option to customers.

The following are disadvantages to remain aware of when incorporating online bill pay into your service offerings:

- Technical issues: As with anything that relies on computer systems, your online bill pay offering could be vulnerable to outages, hacking or data breaches.

- Fees: While online bill payment can be cost-effective, it is important to consider the initial costs associated with setting up and maintaining the service. When adding online bill pay as an option consider software or subscription fees, hardware upgrades and IT support.

- Payment delays: When using a third-party processor or financial institution to transfer funds, it can result in payment delays between your business and the customer.

How to set up online bill pay with a bank

While each bank, credit union, or financial institution may have their own little quirks in the process, future bill pay users generally need to follow the same overall process to make it happen.

First, prospective users will want to gather the information necessary for any accounts, payees, and billers they’ll want to set up automatic payments for. This will usually include account numbers, addresses, and potentially other basic information.

Next, users would sign into their bank or credit union’s online portal and navigate to online bill pay. From there, it’s time to start entering the information for each individual recipient of online bills.

Then they would want to dictate important details about their bills, such as payment timing, recurring vs. one-time payments, and reminders that can be sent from their bank to let them know a bill is about to be paid so they can budget accordingly.

How to set up bill pay with an online service provider

Setting up online bill pay directly with a service provider varies depending on the type of bill pay you are setting up.

With most online bill pay offerings like PayPal, Stripe or Square,, the following steps should be followed:

- Open online payment service you will be using

- Create an account

- Add billing information (address, account number, name)

- Set up automatic payments

- Verify that the right amount is being pulled from your bank account on the correct recurring date

For businesses looking to offer online bill pay as an option for paying customers there are some alternate steps to take.

It is important to first identify the payment needs of the company and determine what payment forms you want to accept. These can include debit cards, credit cards, or bank transfers.

Some additional things to look for as you are considering online bill pay platforms are:

- Payment and fraud prevention security measures

- Integrations into your business's existing payment process

- Pricing and fees

Choosing from online bill pay services

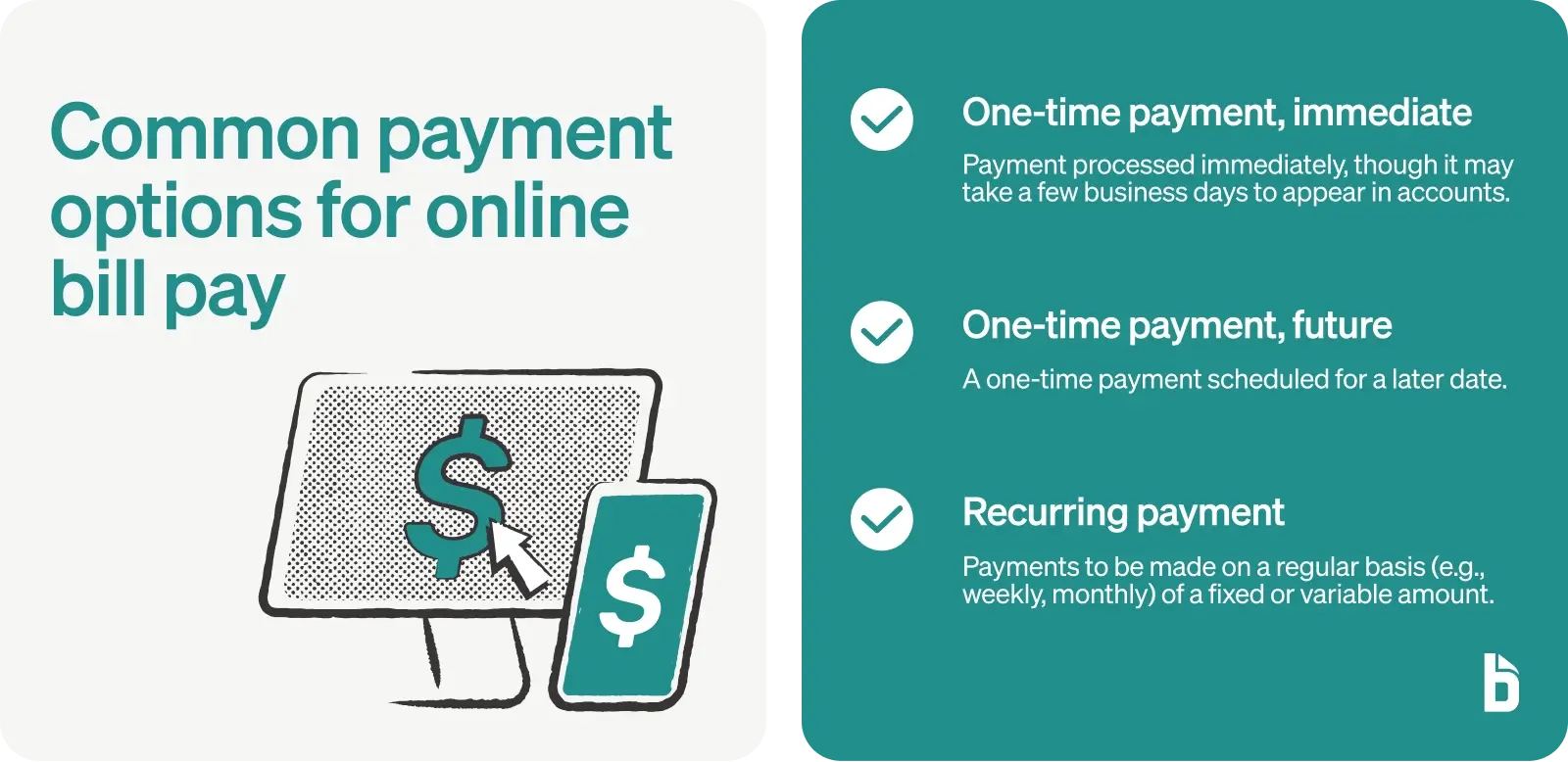

Wondering what types of payments a user can make through online bill pay? Here are the most common options.

One-time Payment, Immediate: A one-time payment that’s processed immediately upon submitting it. While the payment may take a few business days to show up in a user’s bank account and the service provider account, it will usually be dated for the day it is submitted.

One-time Payment, Future: If a user wants to set up a one-time payment for a later date, nearly all service providers will let them do so. Users can specify the amount they want to pay and the date they want the payment to be withdrawn.

Recurring Payment: Recurring payments can be set up to be made every week, month, or in some cases a different billing cycle. Users can set a dollar amount to be their minimum monthly payment or a different amount.

What does online bill pay cost?

Online bill pay can vary depending on the software or payment service provider that is being used. The four most commonly associated costs with online bill pay are:

- Transaction fees

- Monthly fees

- Set-up fees

- Integration fees.

These will all vary depending on the platform, the integrations needed for your business to implement online bill pay offerings and the volume of the payments you expect to see come in.

Improve your accounts receivable with online bill pay

BILL offers businesses streamlined payment offerings for their customers to improve accuracy and visibility into payments and provide a quicker way to send and request payments to other businesses. Make all of your payments on one platform with BILL.