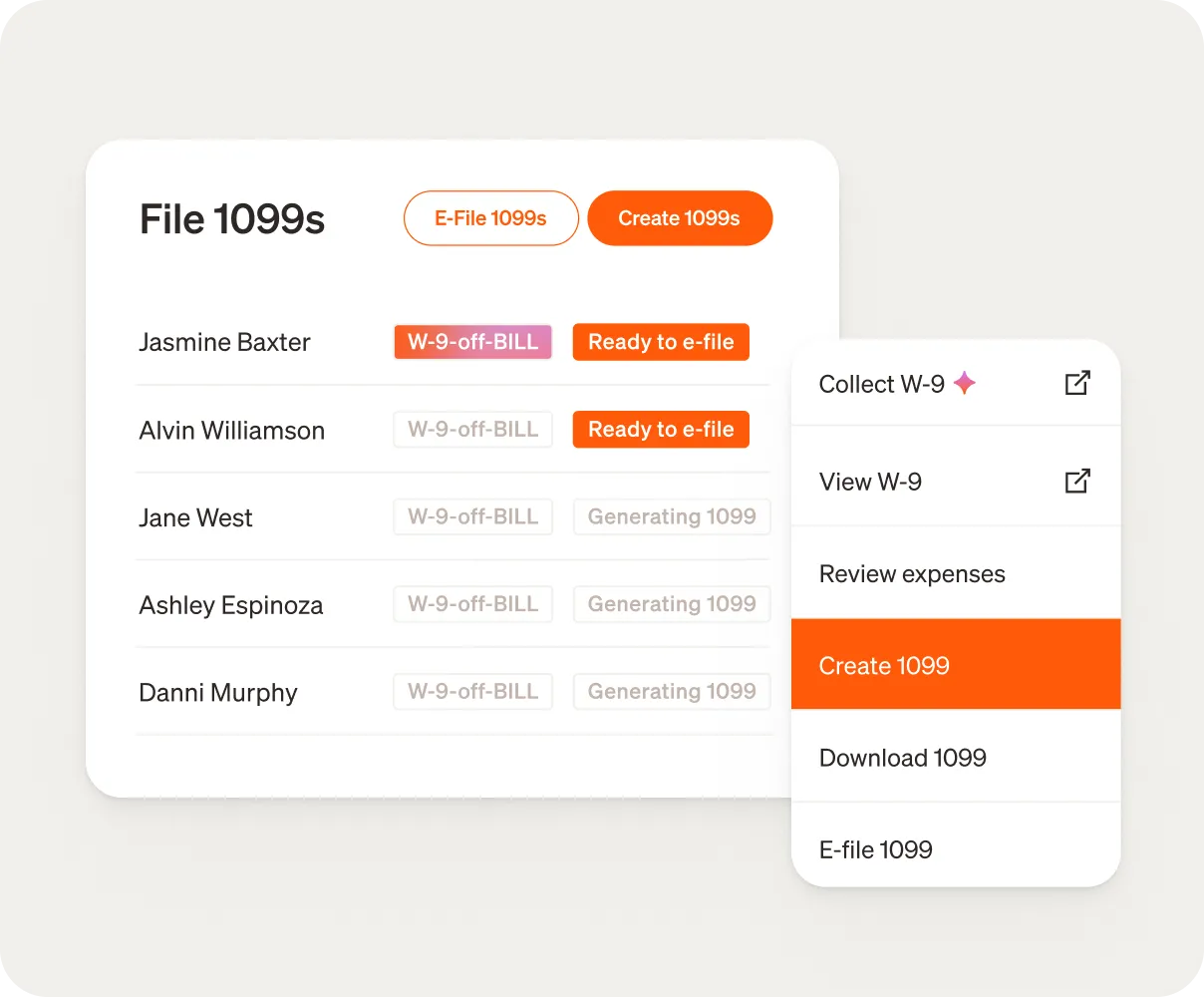

Put tax season on easy mode. From automating W-9 collection with the BILL W-9 Agent, to 1099 filing, BILL has you covered.

a payment?

To accept this invitation, please use the link below.

a payment?

To accept this invitation, please use the link below.

a payment?

To accept this invitation, please use the link below.

a payment?

To accept this invitation, please use the link below.

a payment?

To accept this invitation, please use the link below.

BILL’s 1099 process

It’s a snap.

The foolproof 1099

One platform

Leverage W-9 data

What our customers are saying

What customers are saying

Volume-based discount pricing

Volume-based discounts are available for a limited time. For specific eligibility, deadlines, and rebate dates, please see the additional information below the table.

Discounts are issued as a rebate on March 2, 2026.

Accountant Partners: pricing is based on total console volume; rebates apply only to bill-to-console forms (bill-to-client forms excluded).

Forms purchased after February 1, 2026 are not eligible and will be charged at standard pricing ($1.99 Accountant / $2.99 Direct).

Add-on Mailing and Direct State Filings are not eligible for rebates.

Frequently asked questions

We are currently offering volume-based discounts for the Tax Year 2025—please see the volume pricing table above for specific details. Additional pricing information can be found on our pricing page.

We are currently offering volume-based discounts for the Tax Year 2025—please see the volume pricing table above for specific details. Additional pricing information can be found on our pricing page.

Our features include:

- Collecting W-9s from vendors

- Categorizing expenses

- Generating 1099s

- Filing with the IRS and all 50 states

- Delivering 1099s by e-file or physical mail

And there are more features on the way.

Our features include:

- Collecting W-9s from vendors

- Categorizing expenses

- Generating 1099s

- Filing with the IRS and all 50 states

- Delivering 1099s by e-file or physical mail

And there are more features on the way.

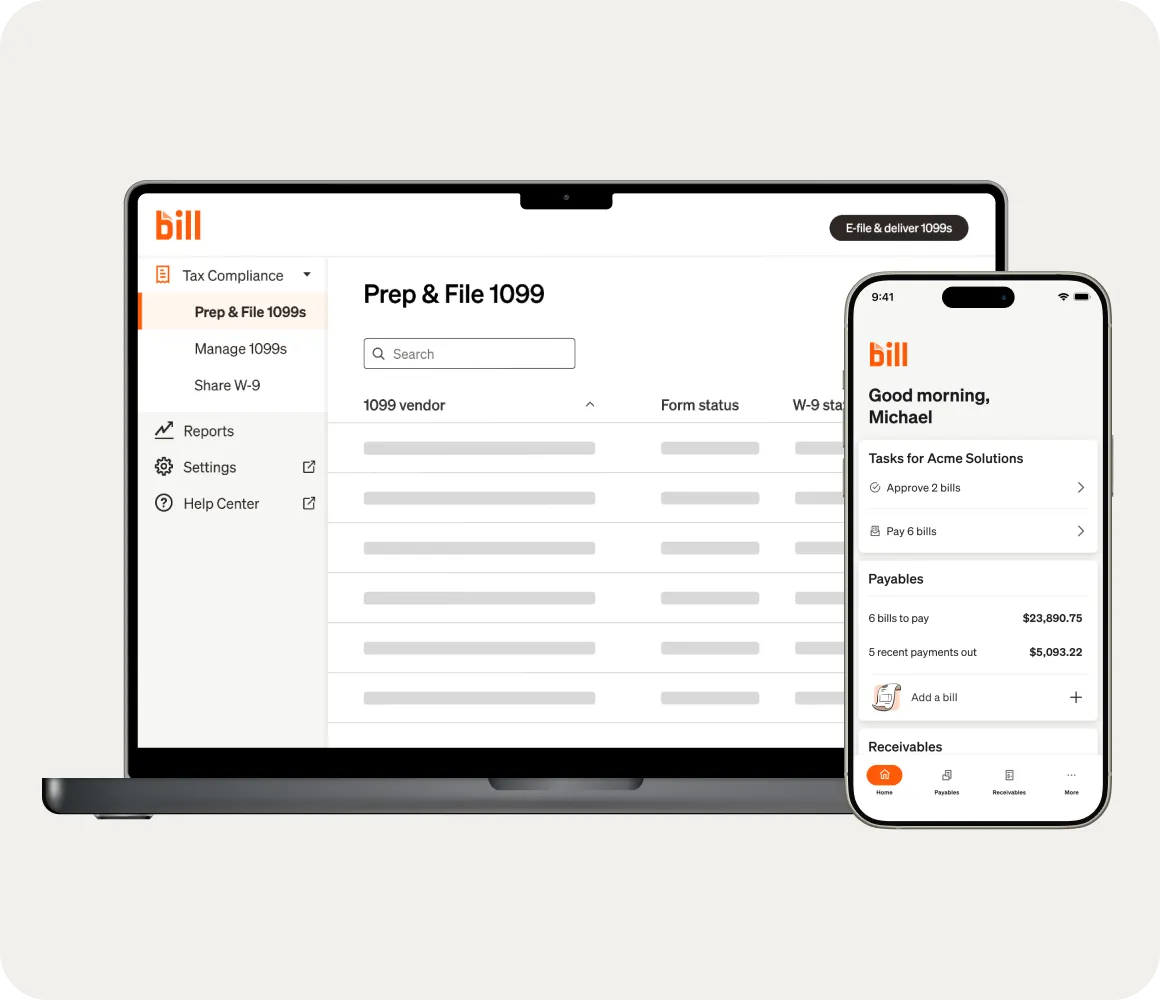

You'll find all 1099 filing forms and processes under the "Tax Compliance" tab on the left-hand side of your BILL account.

You'll find all 1099 filing forms and processes under the "Tax Compliance" tab on the left-hand side of your BILL account.

Need help filing 1099 taxes? 1099 Filing is BILL’s end-to-end 1099 solution, so we handle every step for you. Just use BILL Accounts Payable as you normally do throughout the year, then click a button to file those 1099 forms. Behind the scenes, BILL will take care of everything from W-9 collection to filing with the IRS and all 50 states.

Need help filing 1099 taxes? 1099 Filing is BILL’s end-to-end 1099 solution, so we handle every step for you. Just use BILL Accounts Payable as you normally do throughout the year, then click a button to file those 1099 forms. Behind the scenes, BILL will take care of everything from W-9 collection to filing with the IRS and all 50 states.

1099 Filing from BILL is only available to customers that use BILL Accounts Payable.

1099 Filing from BILL is only available to customers that use BILL Accounts Payable.

BILL makes it easy! BILL can collect, create, and file 1099 tax forms for you, with no outside software needed. We do the hard work—you just click a button.

BILL makes it easy! BILL can collect, create, and file 1099 tax forms for you, with no outside software needed. We do the hard work—you just click a button.

While both types of employees are paid by your company, a 1099 worker is usually a freelancer, contractor, consultant, or gig worker who is in business for themselves. W-2 employees are more traditional employees on your payroll.

While both types of employees are paid by your company, a 1099 worker is usually a freelancer, contractor, consultant, or gig worker who is in business for themselves. W-2 employees are more traditional employees on your payroll.

You can pay 1099 vendors any way they prefer, including:

- ACH Virtual cards

- Pay By Card

- International wire

- Local Transfer

- BILL checks

BILL tracks these payments exactly, which makes sure your 1099s are complete and accurate when you file your taxes.

Learn more in our guide to paying 1099 vendors.

You can pay 1099 vendors any way they prefer, including:

- ACH Virtual cards

- Pay By Card

- International wire

- Local Transfer

- BILL checks

BILL tracks these payments exactly, which makes sure your 1099s are complete and accurate when you file your taxes.

Learn more in our guide to paying 1099 vendors.

Form 1099-MISC is used for things like rental payments to landlords or payments to attorneys—basically anything that is not subject to a self-employment tax.

Form 1099-NEC is for reporting non-employee compensation that is subject to self-employment tax. This includes things like independent contractors payments and vendor payments.

Other 1099 forms include:

- The 1099-K is typically used to report income from third-party payment networks, such as credit card companies, PayPal, or other networks.

- The 1099-R is used to report distributions from retirement accounts, such as pensions, annuities, and other retirement plans.

- 1099-G is used to report certain governmental payments, such as unemployment compensation, state and local income tax refunds, and agricultural payments.

- 1099-INT reports interest income.

- 1099-DIV is used to report dividends and other distributions from investments.

- 1099-B is used to report the sale of stocks, bonds, or other securities if sold through a barter exchange or a broker.

Learn more in our guide to 1099 forms.

Form 1099-MISC is used for things like rental payments to landlords or payments to attorneys—basically anything that is not subject to a self-employment tax.

Form 1099-NEC is for reporting non-employee compensation that is subject to self-employment tax. This includes things like independent contractors payments and vendor payments.

Other 1099 forms include:

- The 1099-K is typically used to report income from third-party payment networks, such as credit card companies, PayPal, or other networks.

- The 1099-R is used to report distributions from retirement accounts, such as pensions, annuities, and other retirement plans.

- 1099-G is used to report certain governmental payments, such as unemployment compensation, state and local income tax refunds, and agricultural payments.

- 1099-INT reports interest income.

- 1099-DIV is used to report dividends and other distributions from investments.

- 1099-B is used to report the sale of stocks, bonds, or other securities if sold through a barter exchange or a broker.

Learn more in our guide to 1099 forms.

Manual W-9 collection can be a challenge—that’s why the BILL W-9 Agent automates the process for you. Learn more about W-9 collection.

Manual W-9 collection can be a challenge—that’s why the BILL W-9 Agent automates the process for you. Learn more about W-9 collection.

Yes! Once a 1099 has been submitted to the IRS, you will be able to make any adjustments under the “Actions” tab on the 1099 Filing dashboard.

Yes! Once a 1099 has been submitted to the IRS, you will be able to make any adjustments under the “Actions” tab on the 1099 Filing dashboard.

Join the millions who pay and get paid with BILL.