It’s all too common for business owners not to be satisfied with their accounts payable workflow (AP workflow)

According to research, the average invoice exception rate sits at 22%, meaning roughly one out of every four invoices requires manual intervention from the finance team. Having to go back and correct every fourth invoice can lead to an unorganized accounts payable workflow and impact long-term business efficiency.

The first step to improving AP workflow is getting familiar with the key stages in the accounts payable process: invoice capture and data entry; invoice verification and matching; approval and authorization; and payment processing and recording.

Here, we’ll cover the AP process and discuss how businesses can support this critical function by investing in accounts payable workflow automation. We'll answer questions like, "Why is the accounts payable process important?" and discuss the connection between the revenue cycle, accounts payable, and accounts receivable.

Learn tips for improving accounts payable processes, such as integrating accounting tools with your ERP system to create a full cycle accounts management workflow and modernize the way to process invoices.

What’s an accounts payable workflow?

An accounts payable (AP) workflow refers to the complete process of receiving and paying suppliers' invoices. It includes the moment businesses receive the invoice, when it's paid, and every step in between.

Here's a quick rundown of the basic accounts payable process:

- Find a vendor and order a product or arrange a service

- Submit a purchase order

- The vendor reviews the purchase order and provides the product or service

- The vendor invoices the accounts payable department

- Pay the invoice

Generally speaking, the accounts payable workflow process is quite simple. However, business owners often have to deal with more than a single invoice. In reality, finance teams are running through multiple accounts payable processes simultaneously.

When the AP team receives multiple invoices from several different vendors and departments, tracking each request gets rather complicated. Here are some steps your AP team will need to take to ensure prompt and accurate payment execution:

- Verify the authenticity of electronic and paper invoices

- Check for accuracy and ensure that no duplicate payments are issued

- Ensure there is enough cash to perform invoice processing

- Complete the payment process on time

When it comes to managing revenue cycle, accounts payable plays an important role.

Any inefficiencies in your accounts payable workflow can cause major headaches for any AP team and lead to frustration among clients. For instance, if the AP department sends a duplicate payment, it will be important to request a refund from the vendor.

While you'll eventually get that money back, it will be tied up for days or even weeks while you sort out the error. Recalling the duplicate payment will also tie up members of your AP department and distract them from addressing outstanding invoices.

Create an efficient and nimble account payable workflow. AP automation solutions can help to prevent human error, avoid late fees, and honor the payment terms all parties agreed to.

Let's dig a little deeper into the core steps of accounts payable before exploring how automated accounts payable software can be a game changer for any business.

4 steps of the accounts payable workflow

The AP workflow includes four major steps:

- Invoice capture and data entry

- Invoice verification and matching

- Approval and authorization

- Payment processing and recording

Here are the individual steps to take and how to improve each one of them within your AP workflow:

- Invoice capture and data entry

The initial steps in the accounts payable process include invoice capture and data entry.

These involve collecting and inputting information from vendor invoices into the accounting system, which is often tedious and error-prone in manual processes.

Optimize invoice capture and data entry by:

- Regularly training accounts payable staff on capture and entry best practices.

- Centralizing important financial documentation to speed up processing time.

- Monitoring invoice performance metrics to track irregularities and fix errors.

- Utilizing software solutions that can automate both capture and data entry. (like BILL)

- Implement data analytics to help identify patterns and opportunities to improve.

- Periodically auditing to identify and minimize delays, friction points, and compliance errors.

Following these suggestions can help conserve time and resources, allowing the AP team to focus on more strategic tasks to grow the business.

- Invoice verification and matching

Verifying and matching invoices are integral steps in the AP process that ensure invoice accuracy and legitimacy.

This involves:

- Comparing invoices to purchase orders (PO), receipts, contracts, and other documents

- Confirming that the items listed in the invoice match the purchase order

- Checking each line item and quantity

- Ensuring that only accurate and legitimate invoices are approved for payment

Manually performing each of these steps not only takes time but also leaves room for error.

Luckily, with the right tools, businesses can automate the process.

For instance, with BILL, your PO and receipt details sync directly from your accounting, which speeds up the matching process.

3. Approval and authorization

Getting invoices approved is a critical step of the accounts payable workflow.

Ensuring that invoices are reviewed and approved by the appropriate personnel before payment is made helps prevent unauthorized transactions and acts as a deterrent against fraud.

Implementing a multi-step approval process for accounts payable can ensure that multiple people have reviewed and approved every invoice to prevent errors, duplicate payments, and unauthorized payments.

However, one of the biggest problems with multi-step approval is making sure reviewers do their approvals on time.

It's easy for an invoice to be overlooked and sit in someone's queue for days or weeks. This increases the likelihood of late payments and fees.

To reap the benefits of a multi-person approval process while avoiding the common pitfalls, use accounts payable workflow automation to:

- Define which invoices require approval

- Designate who approves which invoices

- Give stakeholders the ability to track the status of pending invoices

- Automatically route invoices to the correct approvers

4. Payment processing and recording

The final steps in the accounts payable workflow are processing and recording payments, which involves issuing payments to vendors and updating the accounting records accordingly.

First comes payment processing, which involves scheduling and executing payments according to their payment type and the dates they are scheduled.

Then, upon the payment, the transaction must be recorded in the company's general ledger, ensuring accurate financial reporting.

The importance of an efficient accounts payable workflow

Modernizing an accounts payable workflow benefits the business, AP team, and vendor partners. Streamlining revenue cycles and accounts payable processes can open the door for the following benefits:

Cost savings

Maintaining a clear view of accounts receivable, accounts payable, and payment approvals will help the business to have a clearer understanding of its cash flow. Use these insights to identify cost savings opportunities and reduce waste from the procurement phase of purchasing.

Automating accounts receivable and payable can also lead to direct cost savings. For instance, replacing manual data entry and eliminating paper documents through the use of an AP automation solution can reduce human errors and help companies avoid late fees. Accelerating AP processes may also allow companies to take advantage of early payment discounts.

Improved cash flow

While you want to ensure a quick payment authorization to settle outstanding accounts, you also need to maintain a clear view of incoming and outgoing cash. Holistic accounts payable workflows provide a big-picture view of upcoming costs, incoming revenue, and whether you have enough cash to cover your costs.

Updating AP workflows will make it easier to time outgoing payments with receivables. Create a schedule for paying invoices and spread out AP processes to ensure that the company doesn't have too much money coming out all at once.

Better vendor relationships

Improving your accounts payable system is a great way of forging better vendor relationships. Vendor partners don't want to wait weeks for invoice approval and payments. They expect an efficient accounts payable process and timely payments on all outstanding debts.

Creating an accounts payable cycle that makes life easy for vendors will lead to stronger relationships and happier partners. In turn, they may reward businesses with discounts, favorable vendor invoice terms, and priority service.

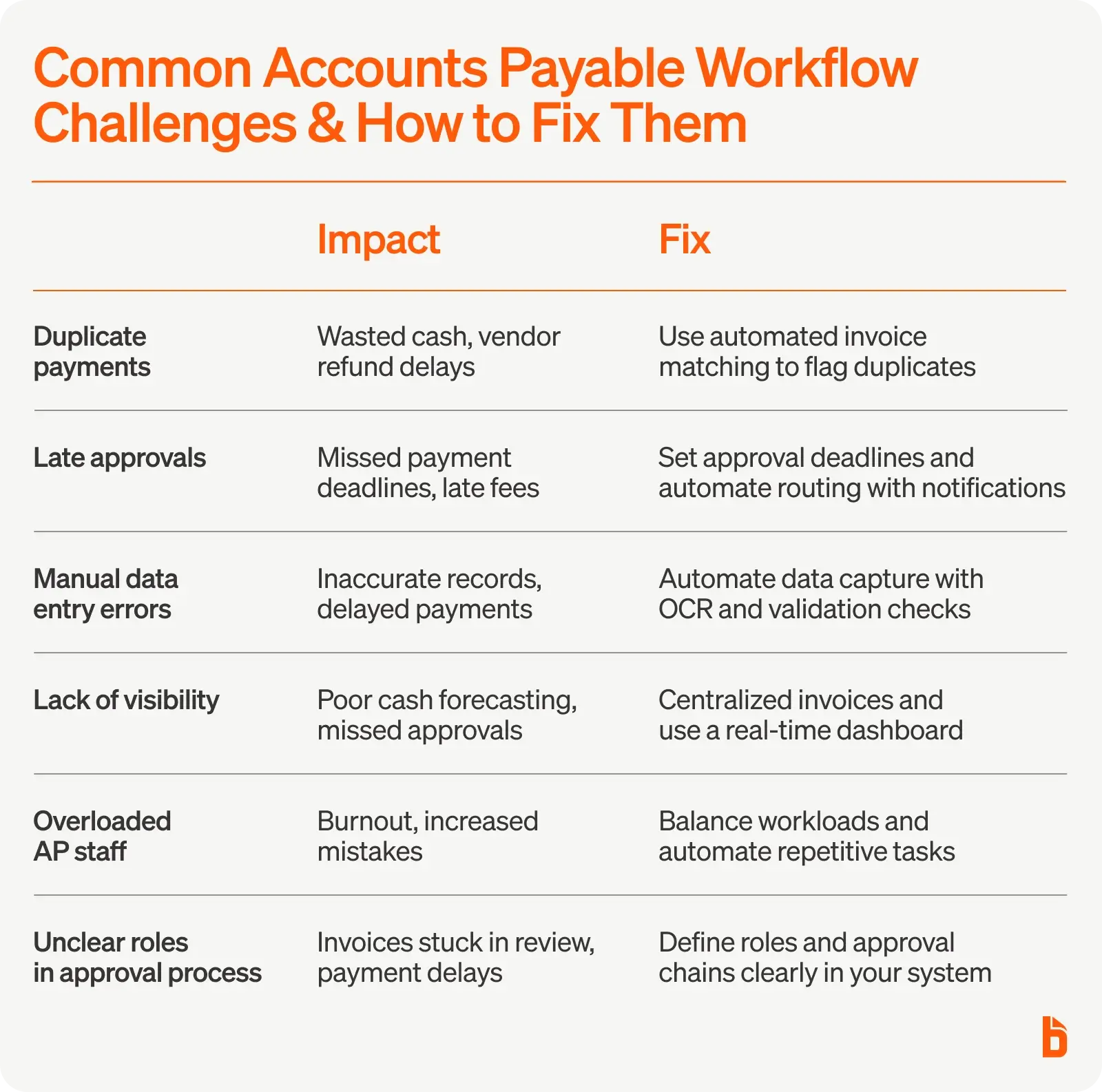

How to overcome common challenges in the AP workflow

Upgrading an accounts payable workflow poses unique challenges.

Inaccurate and mismatched invoice data can result in costly delays, while manual processes can consume a significant portion of the AP team's time.

Here's how to avoid these costly challenges and turn an accounts payable workflow into a well-oiled machine.

Reduce data entry errors

Errors occurring amid the invoice capture and data entry process can heavily influence the efficiency and accuracy of the accounts payable process.

Minimizing these errors is vital to maintaining a stable cash flow and ensuring vendors receive payments on time.

Some of the more common errors found in the data entry process include:

- Omissions or duplications of an entry

- Including an unnecessary digit or decimal

- Missing a digit or decimal

- Unintentionally switching numbers' positions

- Entering data into the wrong fields or account

Here's how to effectively minimize data entry errors in your accounts payable workflow:

- Balanced Workloads: Overworked staff members are more likely to make simple entry errors. Ensuring that a team has a balanced workload will help minimize mistakes and prevent burnout.

- Data Validation Checks: Implementing data validation checks can further ensure the accuracy of the data entered, reducing the potential for discrepancies and delays.

- Automation: By automating invoice capture and data entry, companies can save time by offloading tedious and repetitive tasks.

Streamline approvals

Refining the approvals and authorizations stage is another way to make your accounts payable workflow more efficient.

Here are some tips to prevent obstacles and systemize your invoice approvals process:

- Establish well-defined deadlines for each approver.

- Minimize redundancies by assigning roles and responsibilities to specific staff members.

- Implement controls that ensure all parties are accountable for their part of the process.

Increase visibility and collaboration

Disorganization can inflict damage on your accounts payable workflow.

Luckily, this issue can be fixed by centralizing vital documentation, including:

- Invoices

- Purchase orders

- Receipt reports

When you need to sort through emails, folders, online storage, and even drawers to gather receipts and POs, it's easy for things to get lost.

Centralized documentation allows for easier access to relevant information for everyone involved in your accounts payable workflow.

Optimizing how your team communicates is the other major step of organizing your accounts payable workflow.

Implement accounts payable automation

Optimizing your accounts payable process requires a multifaceted approach, but implementing AP automation is the single most impactful change you can make. The power of automation allows you to streamline several key steps of the accounts payable process, including the following:

- Invoice Data Capture: An automated AP workflow will capture critical AP documents using optical character recognition

- Invoice Processing: The software will then process invoice data, prevent duplicate invoices, and route the documents for approval

- Invoice Approval: Top AP workflow automation tools automate the approval process by sending documents directly for final approval, which businesses can do electronically

- Payment Processing: After approval, the AP workflow solution will complete the payment process

AP automation technology accelerates the accounts payable process while maintaining invoice data accuracy.

The tools automate invoice data capture and ensure that subsequent business processes are completed using accurate information. Expediting the way businesses collect vendor invoice data while reducing the need for manual work will make things go much smoother for an accounts payable team.

The best solutions further promote full cycle accounts management by integrating with the company’s ERP system. Full cycle accounts management provides a holistic view of all business expenses and incoming revenue. Use this information to transform the AP process into a tool for managing cash flow and maintaining business liquidity.

Revamp your accounts payable workflow with BILL

From automated invoice processing to built-in approval workflows and real-time visibility, our integrated accounts payable and receivable system offers the features businesses need to optimize operations and minimize errors.

With BILL, you can easily track and manage invoices, approvals, and payments all in one place, ensuring your financial obligations are met accurately and on time.

So why wait?

Streamline your accounts payable process while reducing workflow issues by signing up with BILL or requesting a demo!