If you’re not yet using double-entry accounting, it’s time to get on board with this time-tested standard that has balanced books since the 15th century. The fundamentals of double entry haven’t changed in over 500 years for a good reason – it’s a reliable system that reduces the risk of errors slipping through the cracks. So why not join the millions of businesses worldwide that trust double-entry bookkeeping for their accounts?

What’s double-entry accounting?

Double-entry accounting is a method of keeping track of a company’s financial transactions. It works on the principle that every financial transaction has two equal and opposite sides — a debit and a credit.

This system helps businesses record every transaction accurately and issue balanced financial statements. It also helps businesses identify errors and prevent fraud, as changes made to one account automatically affect the corresponding account.

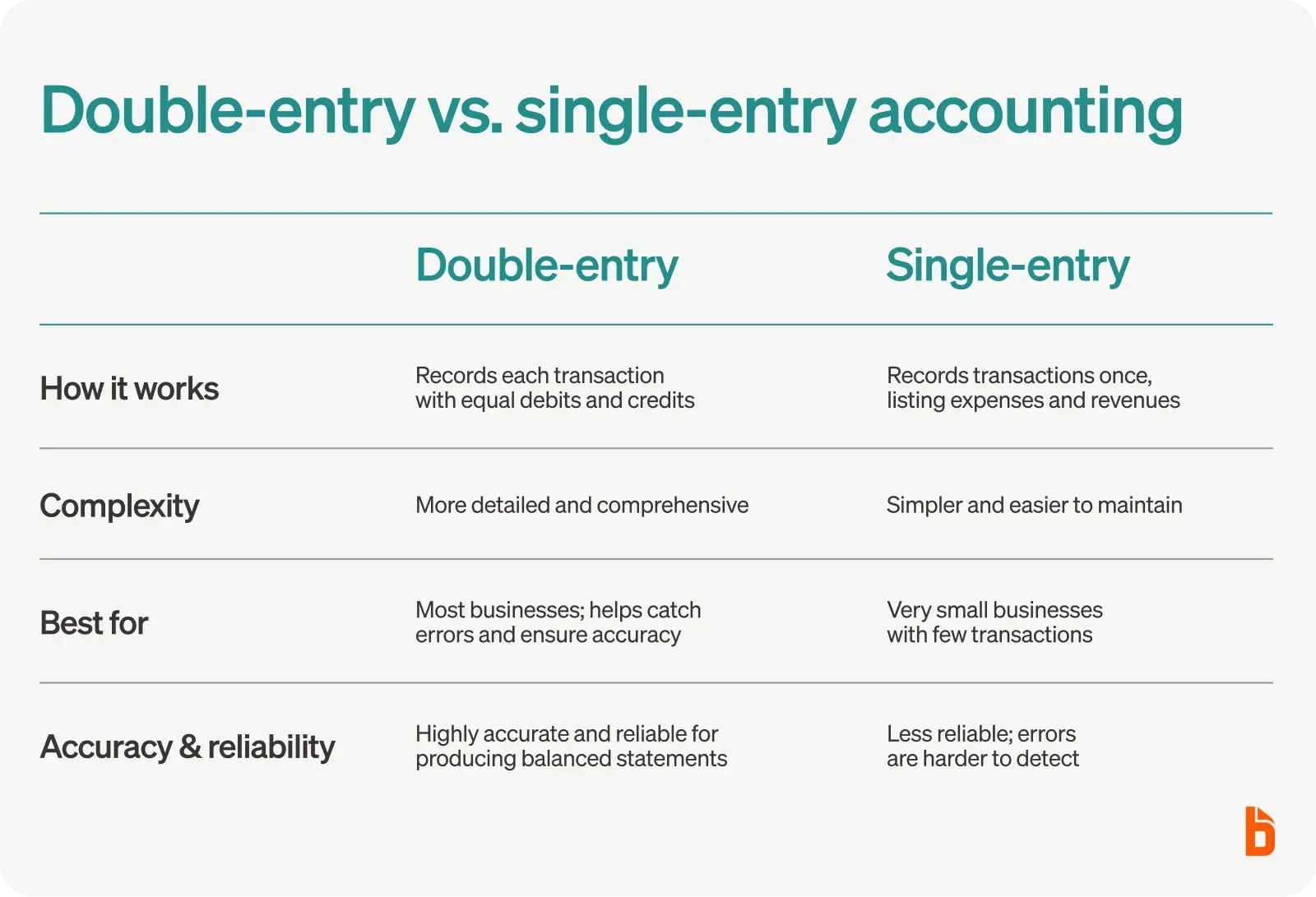

Double-entry accounting vs. single-entry accounting

The double-entry system is distinct from single-entry bookkeeping, where you just list expenses and revenues. Single-entry accounting is more straightforward and works for very small businesses with only a handful of transactions to keep track of.

But it’s not practical for most businesses. While both accounting methods have advantages and disadvantages, double-entry accounting is more comprehensive, accurate, and reliable than single-entry accounting.

How the double-entry system of accounting works

The double-entry system of accounting works by recording every financial transaction in at least two accounts: a debit on one side and a credit on the other.

Businesses use the double-entry system for every financial transaction, whether it’s a purchase, sale, payment, or cash receipt. This system provides a complete and accurate record of a business’s financial transactions. It allows the company to prepare financial statements, such as the balance sheet, income statement, and statement of cash flows.

By using the double-entry accounting system, businesses can ensure their financial records are accurate, reliable, and consistent over time. This, in turn, helps businesses make informed decisions based on their financial data, such as how much inventory to order or whether to invest in new equipment.

Here’s an example of how the double-entry system works. (Don’t worry — we’ll go into a deeper example later.)

Let’s say you buy inventory for your business on credit for $1,000. To record this transaction using the double-entry system, you would:

- Debit the inventory account by $1,000: This increases the value of the inventory on your balance sheet.

- Credit the accounts payable account by $1,000 increases your liability to pay for the inventory.

The total debits ($1,000) must always equal the total credits ($1,000), ensuring the accounting system is accurate and error-free.

Types of accounts

When using double-entry accounting, you’ll use several types of accounts, which you’re probably already familiar with. They’re the primary accounts on your balance sheet and income statements.

- Asset accounts: What a business owns, such as the cash account or the amount paid to purchase machinery

- Liability accounts: What a business owes, such as invoices that need to be paid for services and debt owed for a loan

- Income accounts: Money received from sales revenue

- Expense accounts: Money spent on things for the business, such as payroll, advertising, insurance, and rent

- Equity accounts: These represent the owners’ or shareholders’ financial interest in the company

A unique account number and name represent each account in a company’s chart of accounts. The double-entry system ensures every financial transaction affects at least two accounts, with one account debited and another credited. This system helps ensure accuracy and prevent fraud by providing checks and balances for every transaction.

Let’s look at another example to see how this works.

Say you purchase $5,000 of supplies from a vendor on July 1. The vendor allows you to pay cash upfront for half of the cost of the supplies when you receive them and pay the remaining balance in 30 days. Your initial transaction would be:

On July 30, you pay the outstanding balance with a credit card. Your transaction would look like this:

At the end of August, you pay off the amount you charged to the card. The transaction looks like this:

As you can see from the examples above, each transaction has an equal dollar amount for debits and credits. This helps minimize mistakes.

Does accounting software use double-entry bookkeeping?

If you regret not taking that accounting class in college, there’s good news. Most accounting software systems use double-entry, so you don’t have to select each account manually. But, as a business owner, it is still a good idea to understand how the double-entry accounting system works and why you’re using it, even if your accounting software does all the work.

Why your business should use the double-entry system

Double-entry accounting is beneficial whether you run a public company or a private business. But what do you gain from the double-entry system aside from balanced books? Here are the main benefits of double-entry bookkeeping.

#1: Get a more accurate picture of your financials

Most businesses use double-entry accounting because it offers a complete recording of financial transactions. Since every financial transaction has to be recorded into two accounts, you know the financial records accurately reflect every transaction. An in-depth recording like this provides a comprehensive view of your financial activity and accurate financial reporting across your balance sheet, income statement, and cash flow statement.

#2: Stay compliant with U.S. regulations

Double-entry accounting is required by law for publicly traded businesses. The Securities and Exchange Commission (SEC) requires publicly traded companies to use generally accepted accounting principles (GAAP) based on the double-entry accounting system. Using GAAP and double-entry provides a standardized method for financial reporting, which helps investors compare the financial health of different companies.

#3: Scalable across businesses of all sizes

It doesn’t matter what size your business is — the double-entry bookkeeping system is a practical way to keep track of business transactions because it grows with you as your business expands. You can always add more asset and expense accounts to your chart of accounts. Adding more accounts seriously complicates your books if you use the single-entry system. With double-entry, you can expand from your core financial accounts and add subaccounts as needed.

#4: Prevent fraud through fewer errors

Since transactions must be entered twice, the system helps identify errors and prevent fraud. Also, because there’s a clear and detailed record of all financial transactions, it’s harder for employees or upper management to manipulate or conceal information.

You can also integrate double-entry accounting with other financial tracking systems to provide additional security and fraud prevention layers. For example, some accounting systems allow credit card transaction data to sync with your accounting system, ensuring you never miss a transaction.

#5: Simplifying tax season and audits

Preparing financial statements for tax season is much easier with the double-entry bookkeeping system. Knowing all your accounts are organized and accurate saves time and reduces the risk of errors in tax preparation because it provides a clear audit trail. So, if you were to get audited, it’s much easier for auditors to verify your financial transactions.

#6: Appeals to investors and builds trust with stakeholders

With double-entry accounting, you can generate reliable financial statements that accurately reflect the business’s financial position, helping investors see your financial viability and make informed decisions about investing in the company.

Plus, the accuracy and completeness of the financial records provided by double-entry accounting help build trust with stakeholders — like regulators, creditors, and customers. Accurate and transparent financial reporting demonstrates a commitment to integrity and financial responsibility.

Sync BILL with your accounting software

BILL's seamless integration with most popular accounting software platforms makes implementing your accounts payable and accounts receivable data easier than ever. To make double-entry accounting that much easier, check out BILL's integration options today.