Whether you prepare financial statements intending to go public one day, because grant awards or loan covenants require it, or you simply want bigger investment opportunities, understanding and actively applying generally accepted accounting principles (GAAP) equips you for future success. Let’s take a closer look at what GAAP entails and how you can use it to your advantage.

What are generally accepted accounting principles (GAAP)?

Generally Accepted Accounting Principles—commonly referred to as GAAP—are standardized rules and principles dictating how all U.S.-based, publicly traded companies record their financial transactions and prepare their financial statements.

The goal of GAAP is to promote financial transparency and consistency across companies, which is why these accounting standards are used to prepare financial reports like income statements, balance sheets, and cash flow statements.

The same set of accounting standards is also used by many private companies—either because a lender requires it or they want to follow standardized accounting principles. Issuing GAAP-based financial statements allows investors and other stakeholders to make evidence-based decisions regarding a company’s financials.

History of GAAP

The federal government kicked off an initiative to standardize all accounting principles nearly a century ago. Congress passed the Securities Act of 1933 and the Securities Exchange Act of 1934 in response to the Stock Market Crash of 1929 and the Great Depression.

This legislation created the Securities and Exchange Commission (SEC) and tasked it with enforcing laws, protecting investors, and creating accounting standards. Eventually, other financial organizations—like the Financial Accounting Foundation (FAF) and the American Institute of Certified Public Accountants (AICPA)—founded the Financial Accounting Standards Board (FASB), which is responsible for creating and improving GAAP.

GAAP has evolved over the years, but it continues to apply to businesses across industries.

Why companies use GAAP

Because it’s such a foundational part of accounting, GAAP can impact several business activities, including:

- Recording financial transactions

- Preparing accurate financial statements and related disclosures

- Reducing fraud and misstatements in financial reports

- Comparing financial position and results of operations across GAAP-compliant companies

GAAP is used because of what’s called “comparability.” Compatibility allows for easier comparison when looking at a company’s financial reporting data when that business uses the same accounting principles and reporting standards as most other companies.

This comparability is also what makes using GAAP so practical.

For example, suppose you’re a small business planning to raise capital. In that case, you must ensure that your financial statements are accurate and provide valuable information to potential investors, lenders, shareholders, prospective buyers, and partners.

This way, each stakeholder can look at your company’s financial statements and easily compare them to other companies they may consider working with to determine the best fit for their investment resources.

Advantages of GAAP

- Consistency: GAAP ensures consistency by establishing standardized practices rooted in transparency and honesty. This means all financial transactions are disclosed, complete, and accurate.

- Accountability: It holds organizations accountable to clear financial reporting requirements.

- Birds’ eye-view: A standardized set of accounting and financial reporting rules makes it easy for others, such as investors, to read financial statements and learn about the company’s performance.

- Relevancy and reliability: GAAP reduces the risk of error because it has several safeguards and checkpoints.

Considerations when using GAAP

- Non-global recognition: GAAP’s financial reports are not necessarily recognized globally like the International Financial Reporting Standards (IFRS), which are more commonly used worldwide.

- One-size-fits-all method: This accounting method does not account for the diversity of needs among different companies. For example, small businesses might find it more challenging to incorporate all GAAP principles into an otherwise established financial framework.

- Long wait time for new standards: FASB takes a rigorous approach to proposing new GAAP standards, collecting feedback, and publishing new standards. This extended timeline makes it tough to keep up with the pace of business.

10 core principles of GAAP

If you’re unsure of the difference between the terms “principles,” “guidelines,” and “standards,” then you’re not alone.

Before we get into the ten principles of GAAP, let’s break down the difference between these terms:

- Principles are rules that must be followed when preparing financial statements and can contain a mixture of standards and guidelines

- Guidelines are not so different from principles but are a bit more flexible in the fact that they are broader and can be adopted over time

- Standards offer clear benchmarks and considerations for what should and shouldn’t be performed or common practice

These ten basic principles are a blueprint for what your company should follow when required to comply with GAAP:

1. The principle of regularity

This accounting principle asserts that adhering to GAAP is an around-the-clock job, not just an ad-hoc occurrence. In other words, when preparing financial statements, accountants must always follow GAAP standards and regulations.

How it works

Say you have two accountants located in different locations. One is in New York, and the other one is in California. If the U.S. didn’t have established accounting rules and principles (i.e., GAAP), and each accountant used the accounting rules preferred by companies in their region, it would be impossible for these two accountants to understand each other’s work.

2. The principle of consistency

The consistency principle requires companies to apply consistent standards and practices across all accounting periods and financial statements.

Accountants need to note any changes in their typical accounting practices and provide an explanation and justification in the footnote section of the financial statements. These footnotes give business leaders and investors greater visibility into account balances, practices, and potential risk factors.

How it works

Say you’re are a small business and your accountant, Raphael, uses the cash-basis accounting method to create a profit and loss statement.

Over time, as your small business grows into a larger, publicly traded business, you must start using GAAP. Unfortunately, the cash-basis accounting method isn’t accepted under GAAP, so Raphael must switch to the accrual accounting method and use it for all future financial recordings.

When switching to the accrual method, Raphael must document this change in the financial statement footnotes. He should explain the change and how it might impact future reports.

If the company issues comparative financial statements—meaning it shows two years’ worth of financial information—Raphael will need to restate the prior period financial information to conform with GAAP.

3. The principle of sincerity

Sincerity refers to honestly documenting and disclosing the company’s financial performance. This means the accountant isn’t misleading business leaders, investors, creditors, or shareholders to make the company seem more profitable or financially stable. They have to present all information as accurately as possible.

How it works

Imagine your business, NextGen Lenders, struggled to reach its sales goals this year. But luck knocked on the door, and a funding opportunity from Gama appeared.

Raphael, who is still your accountant, is preparing the financial statements so Gama can look at them. Should he misrepresent information, presenting higher revenue to put NextGen Lenders in a more favorable investment position?

Under the principle of sincerity, he can’t—and most importantly—shouldn’t do that. Raphael is required to prepare financial reports fairly and accurately without misleading anyone.

4. The principle of permanence of methods

Accountants must also use the same financial reporting methods across financial statements. Committing to a single method when preparing financial reports makes it easier to compare them when required—and it also proves that the company follows best practices.

How it works

Raphael decides to take a three-month sabbatical. You bring in another accountant, Ben, to fill in while Raphael is out. Ben should be able to look at your company’s books and reach the same conclusions as Raphael did because the same accounting methods were used throughout the business’ operations.

5. The principle of non-compensation

This principle asserts that accountants must report all positive or negative financial performance with no prospect of debt compensation across accounting records.

How it works

Your temporary accountant, Ben, noticed the company has some debts that won’t look good to shareholders. He thinks it’s okay to hide the increasing debts behind the revenue. But the principle of non-compensation says accountants can’t cover up accounting facts for any reason.

6. The principle of conservatism

The conservatism principle (sometimes known as the principle of prudence) states that financial statements should not include any speculation.

How it works

Say Red Inc. is suing Blue Inc. for patent infringement and foresees winning a considerable settlement. Since the settlement is uncertain, Red Inc. doesn’t record this anticipated gain in its financial statements.

The reason Red Inc. isn’t recording this potential gain is that it might not end up seeing this gain at all. A sizable financial settlement would skew the company’s financial statements and mislead users, so the potential gain isn’t included in the books.

Instead, prudence dictates that Red Inc. should only include information in the financial statements and footnotes if it has or certainly will take place.

7. The principle of continuity

Also called the “going concern” principle, continuity says accountants must prepare financial statements assuming the business will not cease to operate in the foreseeable future.

How it works

Your company, Limitless, makes plastic bottles. Then, suddenly, plastic bottles become illegal. Limitless only produces plastic bottles, so you can’t apply the principle of continuity when preparing the company’s financial statements because Limitless will soon be out of business.

8. The principle of periodicity

This principle requires companies to stick to a standard accounting period when providing financial reports. It can be divided into specific periods, fiscal quarters, or even years.

How it works

Say your company is preparing its financial statements. It decides to do so for July, misses Augu, and issues a quarterly financial statement at the end of September. This does not work. If your company issues financial statements, it needs to use consistent accounting periods, with no ad-hoc reporting for the sake of convenience.

9. The principle of materiality

The principle of materiality refers to reporting transactions that have a material impact on either the financial statements or future performances of a business.

In other words, this principle states that any item (usually one likely to impact an investor’s decision on a business) must be recorded in detail on financial statements.

How it works

Your company purchases a $50,000 piece of equipment, but your accountant accidentially records the transaction as supplies expense instead of capitalizing the equipment and depreciating it over its useful life. Under the materiality principle, you would need to correct that transaction in the financial statements. It’s material to your operations, and leaving the transaction uncorrected could impact an investor’s decision.

You also purchased a $2.00 souvenir while on a vacation, and accidentally paid using your business card instead of your personal credit card. This isn’t material to the business, so it doesn’t need to be disclosed on your financial statements.

(Don’t get the materiality principle confused with the matching principle, which requires you to match expenses with their related revenues in the same accounting period.)

10. The principle of utmost good faith

This principle requires all stakeholders (accountants, business owners, and other relevant parties) to report their financial information with the utmost honesty.

How it works

Your accountant, Ben, is responsible for reporting your company’s financial information to the best of his abilities. He needs to report profit, loss, and other relevant information accurately—no matter how good or bad that might make your company appear.

Alternatives to GAAP

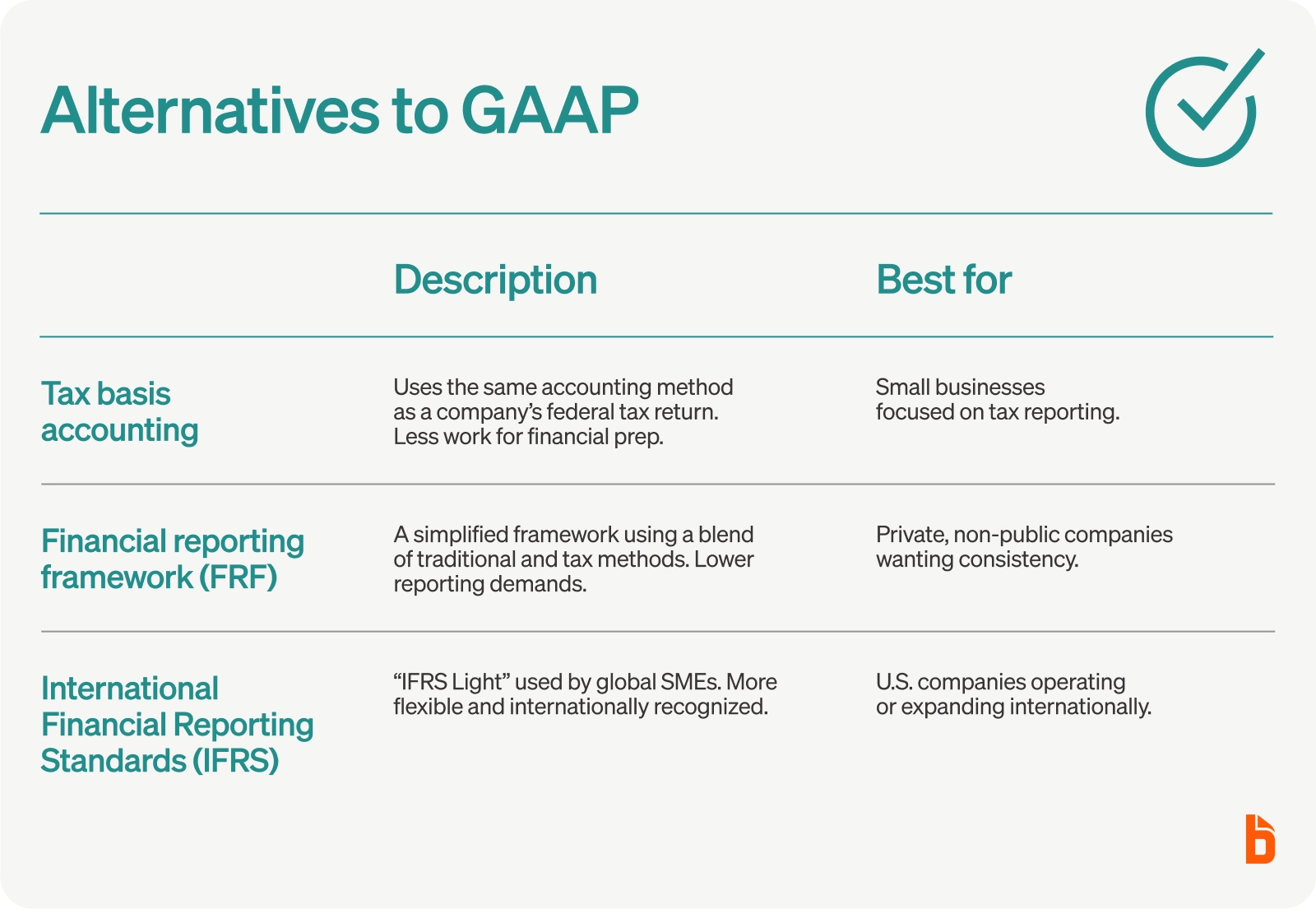

Companies outside of the U.S. don’t have to use GAAP to report financial data. Also, private companies, which includes most small businesses, don’t have to use the generally accepted accounting principles. So let’s look at some alternatives to GAAP:

Tax basis

There are cases when GAAP doesn’t work well for demonstrating a business’ operations. In these cases, companies can use the same basis of accounting they use when filing a federal tax return.

Tax basis accounting means less work when preparing financial statements and tax returns, as the company doesn’t have to make book-to-tax adjustments.

Financial Reporting Framework for SMEs

The AICPA designed the Financial Reporting Framework (FRF) for Small- and Medium-Sized Entities (SMEs) to provide a financial framework that mixes traditional accounting methods with accrual income tax methods.

FRF helps businesses provide accounting information in a simple, consistent, and efficient way. As a financial reporting framework with international recognition, it comes with its own set of benefits, including:

- Less demanding reporting requirements compared to GAAP

- Enhancements to the financial reporting quality

This financial framework targets companies that do not have public accountability—think unlisted companies—and typically issue general-purpose financial statements, which are issued to a broad group of users like investors, creditors, regulators, and management.

Companies might use FRF for SMEs when GAAP isn’t required but they want to prepare financial statements in a consistent and reliable manner. However, this financial framework is not recommended for companies that plan to go public.

International Financial Reporting Standards

Another alternative to GAAP on an international scale is the International Financial Reporting Standards (IFRS) for SMEs. This reporting standard was established in 2009 because SMEs represent more than 90% of companies worldwide.

Otherwise known as “IFRS light,” this is a good option for U.S. companies that don’t plan to go public but are looking to expand overseas or enter the international market.

Some targeted users include (but are not limited to) venture capital entities providing lending, vendors or suppliers assessing the financial health of foreign customers or suppliers, and lenders to multinationals, to mention just a few.

Many differences exist between the two:

- They’re used differently. Only U.S.-based publicly traded companies must use GAAP, but if a company has foreign subsidiaries, it must follow GAAP and IFRS.

- Flexibility is different. IFRS is viewed as more dynamic, adapting to change easily, while GAAP is perceived as more rigid and slow to evolve.

- Balance sheets are reported differently. GAAP requires asset reporting in order of liquidity with current assets first. In contrast, IFRS reverses the order, starting with non-current assets first, followed by owners’ equity in the middle of the balance sheet.

- Methodological differences exist between the two. GAAP allows First in, First out (FIFO) or Last in, First out (LIFO), while IFRS banned LIFO as an inventory cost method.

GAAP and IFRS are working on merging the two accounting standards to adopt a set of globally accepted accounting standards. Doing so might benefit U.S. and global companies in preparing easy-to-read, comparable financial reports worldwide that are not limited by borders.

An example of GAAP in practice

To put GAAP into perspective, let’s look at income statements as one type of financial reporting. GAAP has two classifications for income statements that are divided between single-step and multi-step income statements.

Example #1: Single-step income statements

A single-step income statement, otherwise known as a profit and loss statement, gives a clearer picture of where you stand financially because, compared to a multi-step income statement, it’s easy to prepare and easy to read.

Let’s take a look at Company A’s income statement for March 2022:

We can see from this example that there is a simple way to calculate the company’s net income—and that’s through subtracting expenses from revenues. With the main focus on the bottom line (the net income), this method is a more straightforward way to understand revenue.

This method is helpful for small businesses that want a simple way to monitor their current financial position.

Example #2: Multi-step income statements

The multi-step income statement format is a bit more complex. This income statement calculates the gross profit as the cost of goods sold subtracted from sales, followed by other income and expenses, resulting in net income before tax.

Ultimately, a multi-step income statement offers more detailed information because it reports gross profit and operating income.

Let’s take a look at Company B’s income statement for March 2022:

Looking at this income statement, you can see the financial entries are presented differently: There’s an itemized breakdown of the company’s revenue and expenses split into operating and non-operating income and expenses.

This method is helpful for businesses looking to apply for a loan or present information to a potential investor—because, as always, the more information, the better.

How to make GAAP work for your business

Publicly traded companies in the U.S. must use GAAP, but most small to midsize privately-owned businesses choose another financial reporting framework.. GAAP becomes imperative when your company is getting ready to have an initial public offering, looking for funding, or wants to merge with a publicly traded business.

GAAP guidelines help improve consistency and understanding between accountants and ensures companies follow proper accounting practices. In a nutshell, it helps you take control of your company’s financial information.

But if you’re required to use GAAP and don’t, there are consequences. Costly ones. Errors, fines from the SEC, investor lawsuits, or impacted credibility with investors and other parties are all potential consequences of not following GAAP.

So what can your company do to ensure GAAP compliance?

Step #1: Establish good hiring practices

It may seem like a no-brainer, but hiring the right individuals who align with your company’s value system is crucial.

When hiring, look for candidates who:

- Understand double-entry bookkeeping since GAAP requires this for fewer errors

- Have experience using accrual-basis accounting, which is the only accounting method accepted under GAAP

- Can research and cross-reference GAAP-related standards

You should hire employees who exhibit transparency, honesty, and accuracy—all principles closely tied to GAAP.

Step #2: Provide regular company-wide training sessions

Research shows training and development increases morale, productivity, and skill in their employees. Giving employees a regular refresher on GAAP standards can help them stay on top of the latest changes and avoid errors in your financial reporting.

Step #3: Schedule annual external audits

Nobody likes to hear the word “audit,” but an external audit can benefit for your organization.

- External audits provide credibility to the government, investors, customers, and stakeholders, which is essential when you’re looking for funding or partnerships

- Since you don’t know how something works until you put it to the test, an external audit can improve internal systems and the way your accounting department operates

- In performing an external audit, you might discover potential errors that have to do with your GAAP compliance, allowing you to make changes so you can stay on track

- Most business owners aren’t accounting experts, no matter how much they try to stay in the loop. An external audit is a great learning opportunity and can further educate business owners on the ins and outs of their financials

Independent accounting firms perform external audits to help businesses understand their financial standing and comply with relevant rules and regulations.

Does GAAP impact taxes?

Taxes are heavily reliant on accounting. What you owe and what you can deduct depend on the information you have in your accounting system. Your business structure and accounting method affects how you file, when your taxes are due, and what taxes you must pay.

On the other hand, taxes impact your business’s net income. Here’s how:

- Depending on your business type, what you owe for taxes directly affects your net earnings.

- Tax expenses limit the profit that may go to shareholders and investors.

Recording and tracking all your taxable income and deductible expenses can be difficult—especially when you have a large volume of transactions.

This is exactly why medium-to-large businesses and corporations hire a dedicated tax accountant or tax accounting department. These accountants focus on everything tax-related, like tax returns and payments, qualifying deductions , investment gains and losses, and tax credits.

Use expense management software to stay GAAP-compliant

When you have a platform for managing spending, accounts payable, and accounts receivable, it’s easier to conform with GAAP and feel in control of your company’s financial health.

BILL’s integrated platform automatically syncs with your accounting software or ERP system to reduce manual data entry and speed up month-end close so you can issue GAAP-basis financial statements.

Ready to take your financial reporting to the next level? Schedule a BILL Spend & Expense demo today.