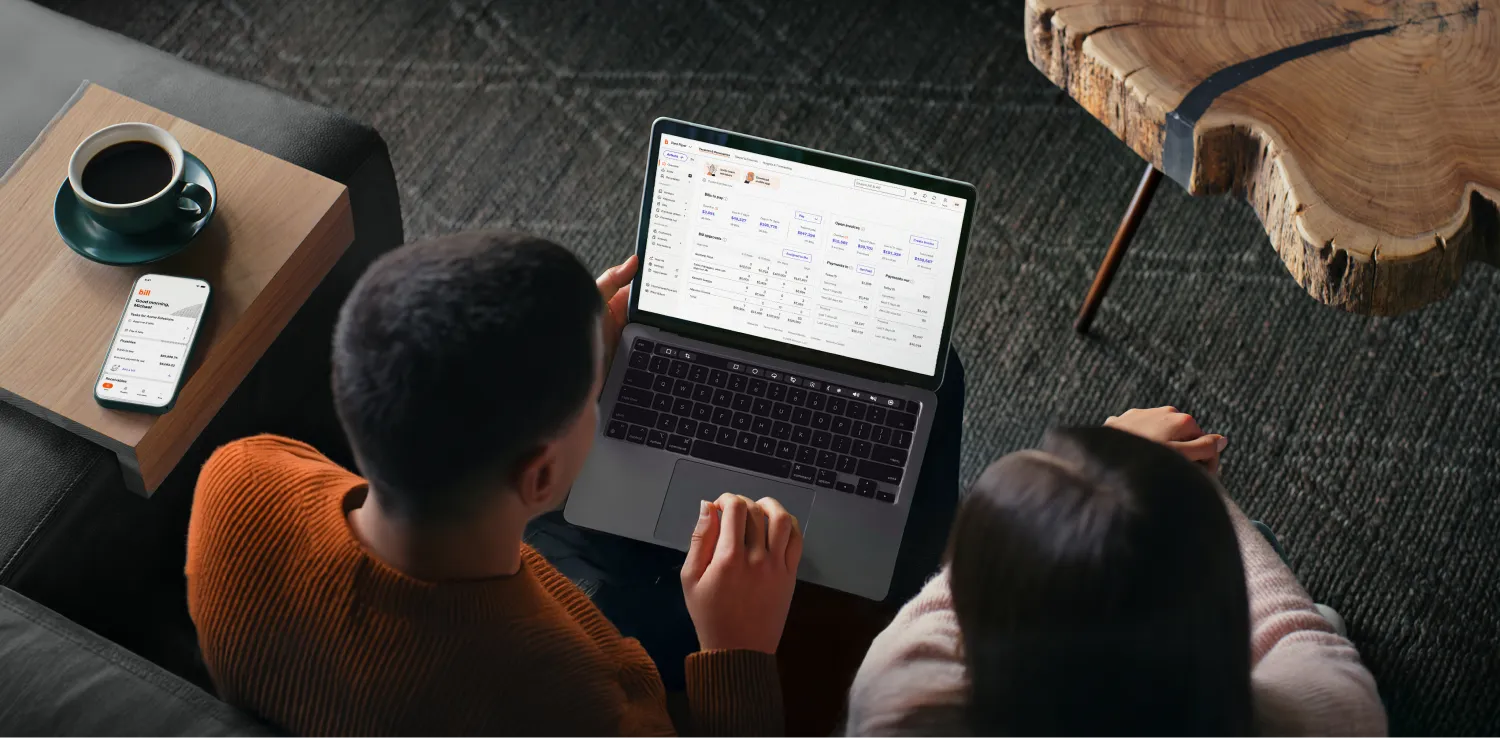

With AI-powered AP automation, BILL erases the busywork from capturing invoices, routing approvals, and processing payments—syncing seamlessly with your accounting software so you can focus on growth.

a payment?

To accept this invitation, please use the link below.

a payment?

To accept this invitation, please use the link below.

a payment?

To accept this invitation, please use the link below.

a payment?

To accept this invitation, please use the link below.

a payment?

To accept this invitation, please use the link below.

Pay up to 2,000 bills at a time—

with busywork erased at every step

BILL AI automatically codes multi line items bills reducing manual time by 20%* while capturing key invoice fields with 99% accuracy.** BILL also automates 2- and 3-way matching—checking invoices against POs and receipts to reduce errors and cut manual work.

Tailor your approval workflows to fit your business rules with BILL handling the routing for you. Track every step, send reminders, and approve from anywhere—speeding payments while strengthening security.

**Based on BILL’s analysis of the top 20% of common bills assuming doc layouts and user behaviors stay consistent. Results will vary by invoice layout and data quality

Accounts payable automation—built for growth

BILL powers nearly half a million businesses with solutions for intelligent finance. With our newest AP features, we’re giving you smarter ways to scale and bring your future into focus.

Delete repetitive tasks with BILL Multi-Entity’s centralized, automated AP. Approve, review, and pay bills across entities and locations all in one place so you can get back to planning your next expansion.

Turn everyday cash into a strategic advantage. BILL Cash Account gives you 3% APY¹ today on your operating cash and next-day ACH payments with no minimum balance or additional fees²—all from one interest earning account.³

With BILL AI, accounts payable automation gets faster, smarter, and more accurate—freeing finance teams to focus on strategy, not data entry.

Predictive AI monitors your transactions in real time to detect suspicious activity and stop fraud in its tracks. And with our intelligent approach to vendor onboarding and validation, you can safely add vendors with confidence.

Powered by 300M transactions across our network, BILL’s AI processes over 5M predictions every day—delivering 95% day-one accuracy in auto-capturing key invoice fields.

With AI-driven vendor search, invoice predictions, and automated coding, manual work shrinks and accuracy improves—so you can process payables faster.

BILL AI isn’t bolted onto one product—it's embedded across your workflows, delivering intelligent automation that cuts silos, connects workflows, and clears the path to growth.

What our customers are saying

*Based on a 2023 survey of over 4,000 BILL customers.

**Based on a 2024 survey of over 4,000 BILL customers.

Boost efficiency with AR & AP on one platform

Get the complete picture of money coming in and out of your business to make more informed decisions, faster.

Work in one system that easily syncs both ways with your accounting software. There’s no need for separate software solutions for each side of your cash flows.

Reap the benefits from both sides of the platform. Get paid two times faster and save up to 50% of time spent on accounts payable.*

Frequently asked questions

AP automation, or accounts payable automation, uses automation technologies and digital processes to streamline the accounts payable process. It improves a finance team's efficiency, making AP faster, more productive, and less costly.

Cloud-based technologies convert the manual processes of entering individual invoices and signing checks into digital systems—turning your AP process into a competitive advantage. They read and store each invoice, manage billing communication, and make payments, all from one accounts payable solution that can be accessed remotely.

That does NOT mean that a computer system is taking over and paying every bill automatically. Far from it.

Any good accounts payable automation solution will use your own approval processes. If a new invoice should require 3 approvals before it gets paid, the platform will automatically route that invoice to the right people for those approvals.

AP automation is designed to improve the efficiencies of your AP department, applying your own trusted workflows in a faster, easier way, with less chance of human error.

AP automation, or accounts payable automation, uses automation technologies and digital processes to streamline the accounts payable process. It improves a finance team's efficiency, making AP faster, more productive, and less costly.

Cloud-based technologies convert the manual processes of entering individual invoices and signing checks into digital systems—turning your AP process into a competitive advantage. They read and store each invoice, manage billing communication, and make payments, all from one accounts payable solution that can be accessed remotely.

That does NOT mean that a computer system is taking over and paying every bill automatically. Far from it.

Any good accounts payable automation solution will use your own approval processes. If a new invoice should require 3 approvals before it gets paid, the platform will automatically route that invoice to the right people for those approvals.

AP automation is designed to improve the efficiencies of your AP department, applying your own trusted workflows in a faster, easier way, with less chance of human error.

Most accounts payable systems are already digitized to some degree. Business accountants use software like QuickBooks, Oracle NetSuite, Sage Intacct, Xero, and other accounting tools to keep financial records. That accounting software tracks income, expenses, assets, and liabilities—invoices that have been processed, bills that have been paid, and other business transactions.

Today, accounts payable automation platforms integrate with that software to take digital automation to the next level. The BILL platform, for example, can capture information from an invoice automatically and digitize it for your review. It can automate your approval workflow. It lets you make payments by ACH, virtual card, physical check, or even international wire. It handles invoice processing, electronic documents storage, authorization, and payment, all from one convenient dashboard.

And because it integrates with the major accounting software platforms, it reduces the effective chance of human errors. The data entered in BILL is automatically synced and posted to your general ledger.

Most accounts payable systems are already digitized to some degree. Business accountants use software like QuickBooks, Oracle NetSuite, Sage Intacct, Xero, and other accounting tools to keep financial records. That accounting software tracks income, expenses, assets, and liabilities—invoices that have been processed, bills that have been paid, and other business transactions.

Today, accounts payable automation platforms integrate with that software to take digital automation to the next level. The BILL platform, for example, can capture information from an invoice automatically and digitize it for your review. It can automate your approval workflow. It lets you make payments by ACH, virtual card, physical check, or even international wire. It handles invoice processing, electronic documents storage, authorization, and payment, all from one convenient dashboard.

And because it integrates with the major accounting software platforms, it reduces the effective chance of human errors. The data entered in BILL is automatically synced and posted to your general ledger.

AP automation saves accounting professionals and finance departments a lot of hours. That's the first thing. In fact, our customers report saving, on average, 50% of their AP time.*

That's time you could spend working more strategically, investing in active growth.

It's also more secure than manual systems. AP automation provides electronic payments, automated approval routing, a digital audit trail, and far better transparency than paper invoice management. It also protects your organization by keeping your bank account information hidden from vendors and suppliers.

Cloud-based AP automation lets finance teams work remotely, with more control, visibility, and transparency than an office-based paper system. It lets busy executives ask questions, see each response, and approve invoices with ease, from anywhere, even on a mobile device.

And it can significantly reduce errors. True AP automation applies machine intelligence to read and enter invoice data for review, flags potential issues like duplicate purchase orders, and syncs with your accounting software.

*Based on a 2021 survey of over 2000 BILL customers

AP automation saves accounting professionals and finance departments a lot of hours. That's the first thing. In fact, our customers report saving, on average, 50% of their AP time.*

That's time you could spend working more strategically, investing in active growth.

It's also more secure than manual systems. AP automation provides electronic payments, automated approval routing, a digital audit trail, and far better transparency than paper invoice management. It also protects your organization by keeping your bank account information hidden from vendors and suppliers.

Cloud-based AP automation lets finance teams work remotely, with more control, visibility, and transparency than an office-based paper system. It lets busy executives ask questions, see each response, and approve invoices with ease, from anywhere, even on a mobile device.

And it can significantly reduce errors. True AP automation applies machine intelligence to read and enter invoice data for review, flags potential issues like duplicate purchase orders, and syncs with your accounting software.

*Based on a 2021 survey of over 2000 BILL customers

The accounts payable workflow begins when a business needs to procure a product or service. That could be anything from electric utilities for the office to contracted marketing agencies. Eventually, that expense payment becomes due, and the organization receives a paper or electronic invoice from the supplier of those goods or services.

First, the invoice data needs to be recorded and filed. Then, the AP workflow requires a storage system, invoice approval, and payment.

It sounds simple, and in a small business, one person might handle everything without any inquiries or special policies. The business owner might glance at the invoice, drop it in a folder, look up their bank funds, write out a check, apply postage and mail it, and then hand the invoice to an accountant at the end of the year in a stack of bookkeeping forms and receipts.

But as a business grows, it can't operate that way for long. Not even with a talented accounting manager.

The volume of papers and bills tends to increase dramatically. Monthly and quarterly reporting demands almost daily verification, and keeping up with the supporting documentation is a real challenge. Accounting systems increase in complexity, and each accounting update takes hours or even days instead of minutes or seconds.

In addition, as the company becomes more valuable, partners, investors, and CFOs demand formal invoice approval rules and compliance processes. Records management. Exception handling.

Add in the considerable hassles of different deadlines and fluctuating cash flow, and that manual system just isn't reasonable anymore. It's not how big business operates.

Successful companies need tools that can grow with them as their accounts payable workflow gets more complex.

The accounts payable workflow begins when a business needs to procure a product or service. That could be anything from electric utilities for the office to contracted marketing agencies. Eventually, that expense payment becomes due, and the organization receives a paper or electronic invoice from the supplier of those goods or services.

First, the invoice data needs to be recorded and filed. Then, the AP workflow requires a storage system, invoice approval, and payment.

It sounds simple, and in a small business, one person might handle everything without any inquiries or special policies. The business owner might glance at the invoice, drop it in a folder, look up their bank funds, write out a check, apply postage and mail it, and then hand the invoice to an accountant at the end of the year in a stack of bookkeeping forms and receipts.

But as a business grows, it can't operate that way for long. Not even with a talented accounting manager.

The volume of papers and bills tends to increase dramatically. Monthly and quarterly reporting demands almost daily verification, and keeping up with the supporting documentation is a real challenge. Accounting systems increase in complexity, and each accounting update takes hours or even days instead of minutes or seconds.

In addition, as the company becomes more valuable, partners, investors, and CFOs demand formal invoice approval rules and compliance processes. Records management. Exception handling.

Add in the considerable hassles of different deadlines and fluctuating cash flow, and that manual system just isn't reasonable anymore. It's not how big business operates.

Successful companies need tools that can grow with them as their accounts payable workflow gets more complex.

The implementation of AP automation streamlines approval workflows for both your accounts payable department and your executive suite.

Add as many controlled rules, roles, steps, and approval processes as you need. As each invoice comes in, BILL matches it to the right workflow and directs it to the right people for approval, handling that distribution automatically.

Need to accelerate the release of that payment? Checking on the status of any invoice is easy. The platform shows you all the events associated and tracked with that transaction so you can locate exactly where it is at a glance.

If there's an issue, you can answer any questions by adding a message right there in the app. Or send reminders to request timely approval and meet your payment cycle.

Give each employee their own controlled access to the application as needed. Thanks to today's automation tools, users can even approve invoices on their mobile phone using the BILL app for Google's Android or Apple's iPhone.

The implementation of AP automation streamlines approval workflows for both your accounts payable department and your executive suite.

Add as many controlled rules, roles, steps, and approval processes as you need. As each invoice comes in, BILL matches it to the right workflow and directs it to the right people for approval, handling that distribution automatically.

Need to accelerate the release of that payment? Checking on the status of any invoice is easy. The platform shows you all the events associated and tracked with that transaction so you can locate exactly where it is at a glance.

If there's an issue, you can answer any questions by adding a message right there in the app. Or send reminders to request timely approval and meet your payment cycle.

Give each employee their own controlled access to the application as needed. Thanks to today's automation tools, users can even approve invoices on their mobile phone using the BILL app for Google's Android or Apple's iPhone.

AP automation software makes the AP process faster and more efficient. It can reduce costs. It can reduce errors. But the right software does more than that. It transforms the AP experience.

Instead of hunting for missing invoices, just search for them digitally and find them in a snap.

Don't dig through your email trying to remember what happened last month. It's all right there, saved in one convenient place.

Automate invoice receiving, data entry, and approval routing, and pay with a few clicks.

Plus, take advantage of early payment discounting and other opportunities for improved terms. Avoid duplicate payments. Advance your reputation and maintain preferred status in your vendor relationships by offering fast, easy payment.

Lower processing costs. Reduce spending with better analytics and insights. Streamline processes, knowing that the right controls are in place and that every invoice is being sent to the right people to be reviewed and validated.

And make monthly statement reconciliation faster and easier than ever.

AP automation software makes the AP process faster and more efficient. It can reduce costs. It can reduce errors. But the right software does more than that. It transforms the AP experience.

Instead of hunting for missing invoices, just search for them digitally and find them in a snap.

Don't dig through your email trying to remember what happened last month. It's all right there, saved in one convenient place.

Automate invoice receiving, data entry, and approval routing, and pay with a few clicks.

Plus, take advantage of early payment discounting and other opportunities for improved terms. Avoid duplicate payments. Advance your reputation and maintain preferred status in your vendor relationships by offering fast, easy payment.

Lower processing costs. Reduce spending with better analytics and insights. Streamline processes, knowing that the right controls are in place and that every invoice is being sent to the right people to be reviewed and validated.

And make monthly statement reconciliation faster and easier than ever.

The difference between a decent accounts payable platform and a great one lies in what AP software can do for you. The right software helps your AP teams and approvers spend less time working with the accounts payable process, giving them more flexibility to focus on other aspects of the business.

Why is BILL the leading provider of AP automation, used by more than 80% of the top 100 accounting firms in the United States? Let’s start with how invoices enter the system.

Vendors can email a digital invoice directly to your dedicated AP address, and the platform starts to process it automatically upon arrival. Still getting invoices on paper? Drag and drop pdf scans into BILL on your computer, or snap a picture with your mobile phone and upload it. It's that easy.

Powered by BILL Artificial Intelligence, BILL gets started as soon as incoming invoices are detected, reading them and extracting data with state-of-the-art optical character recognition, then collecting and entering that information for your review.

Once you confirm that the billing codes, amounts, and other information are correct, BILL automatically routes the invoice to the right people according to your own flexible, customizable workflows. Automate workflows with as many specific rules and controls as you need.

Choose any of our popular payment methods—ACH, virtual card, international wire, or even paper check—and pay with just a few clicks.

Sync your BILL data with your accounting software to keep your general ledger up to date automatically.

But one of the biggest advantages of BILL is how much of a resource the app can be when things don't go right with an invoice—because there are different types of mistakes, problems, discrepancies, or suspicious activity. For example, if a vendor sends a duplicate invoice. Or if an approver is requesting information because they think the amount looks off.

The app has the ability to perform invoice matching and purchase order matching, flagging potential duplication to reduce the chance that you’ll pay the same bill twice.

And any back-and-forth conversation about a bill is stored with the bill itself—logged and time-stamped in a permanent, detailed audit trail just like every other touchpoint from entry to payment, for the kind of transparency investors and loan officers love.

Better yet, BILL is extremely easy to use. Actionable items show up in a user-friendly to-do list. Visible alerts highlight tasks that need your attention. Your team can hit the ground running without complicated instructions, fancy webinars, or in-house training from expensive consultants.

Ready to learn more? Start today with a trial.

We’d love to show you what BILL can do for your AP process.

The difference between a decent accounts payable platform and a great one lies in what AP software can do for you. The right software helps your AP teams and approvers spend less time working with the accounts payable process, giving them more flexibility to focus on other aspects of the business.

Why is BILL the leading provider of AP automation, used by more than 80% of the top 100 accounting firms in the United States? Let’s start with how invoices enter the system.

Vendors can email a digital invoice directly to your dedicated AP address, and the platform starts to process it automatically upon arrival. Still getting invoices on paper? Drag and drop pdf scans into BILL on your computer, or snap a picture with your mobile phone and upload it. It's that easy.

Powered by BILL Artificial Intelligence, BILL gets started as soon as incoming invoices are detected, reading them and extracting data with state-of-the-art optical character recognition, then collecting and entering that information for your review.

Once you confirm that the billing codes, amounts, and other information are correct, BILL automatically routes the invoice to the right people according to your own flexible, customizable workflows. Automate workflows with as many specific rules and controls as you need.

Choose any of our popular payment methods—ACH, virtual card, international wire, or even paper check—and pay with just a few clicks.

Sync your BILL data with your accounting software to keep your general ledger up to date automatically.

But one of the biggest advantages of BILL is how much of a resource the app can be when things don't go right with an invoice—because there are different types of mistakes, problems, discrepancies, or suspicious activity. For example, if a vendor sends a duplicate invoice. Or if an approver is requesting information because they think the amount looks off.

The app has the ability to perform invoice matching and purchase order matching, flagging potential duplication to reduce the chance that you’ll pay the same bill twice.

And any back-and-forth conversation about a bill is stored with the bill itself—logged and time-stamped in a permanent, detailed audit trail just like every other touchpoint from entry to payment, for the kind of transparency investors and loan officers love.

Better yet, BILL is extremely easy to use. Actionable items show up in a user-friendly to-do list. Visible alerts highlight tasks that need your attention. Your team can hit the ground running without complicated instructions, fancy webinars, or in-house training from expensive consultants.

Ready to learn more? Start today with a trial.

We’d love to show you what BILL can do for your AP process.

The start of unstoppable

BILL is reshaping how businesses move, manage, and maximize their money.

The future of finance is intelligent.

More are on the way.

The BILL AI agents are here to help you cut busywork—and we’re just getting started. There are more ways to amplify your impact already in the works, with accuracy you can trust and control that stays in your hands.

BILL has travel plans.

Managing travel spend can be messy—lost receipts, manual uploads, and over-budget bookings. Next stop: more intelligent tools aimed to make business travel effortless for employees and stress-free for admins.

Local simplicity.

BILL already powers payments to 130+ countries and moves over 1% of US GDP. The next chapter: making it as simple for businesses to pay and manage vendors around the world as it is to do business next door.