Invoice payments are a source of stress for businesses.

There's a multi-step process that fills the gap between getting an invoice and making the payment that typically involves different members of different teams.

If your process has a communication breakdown or depends on manual processes, an invoice can slip through the cracks and become overdue.

But it doesn't need to be this way.

Let's start with the basics before we talk about how you can improve the process and make invoice payments simple and stress-free.

What is an invoice payment?

An invoice payment is a payment attributed to an outstanding invoice for any goods or services rendered.

This marks the end of the outstanding accounts payable, following an invoice approval and payment authorization.

The invoice payment process

Unlike a typical transaction that happens at a cash register, invoice payments have multiple stages to the process. This is referred to as the accounts payable process.

The accounts payable process looks like this:

- Invoice capture and data entry: The invoice is received and its information is entered into your accounting system. An accounts payable journal entry is created in the accounts payable ledger.

- Invoice verification and matching: To ensure accuracy, the invoice is compared with purchase orders, receipts, or other procurement documents. Each line item including quantity and price are verified.

- Approval and authorization: The people and teams whom the invoice is relevant to review the invoice to confirm the goods or services were received and accurately billed.

- Payment processing and recording: The payment is processed using the agreed upon method. A second journal entry is created in the accounts payable ledger showing reducing the accounts payable balance.

There’s one final step that isn’t part of the invoice payment process but is still important to spend time on: reviewing your updated accounts payable balance.

In particular, review the balance for accuracy and look for the longest outstanding invoices to follow up on to ensure you’re avoiding any late payment fees or interest.

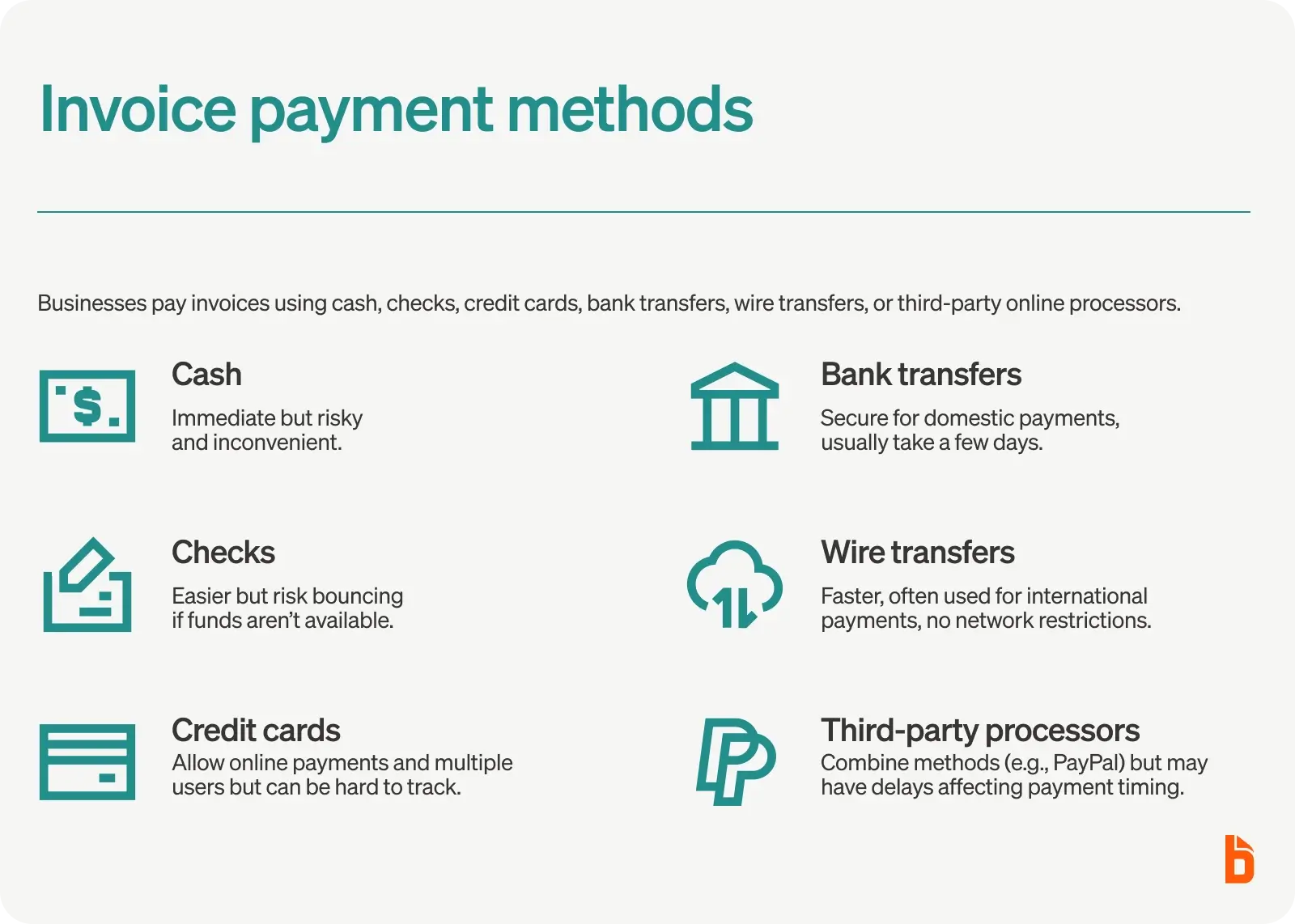

Invoice payment methods

In general, businesses collect payments by:

- Cash

- Check

- Credit card

- Bank transfer

- Wire transfer

- Third party online payment providers

Cash payments

Cash is straightforward with no processing times or chances of the amount bouncing. But it’s also loose and possible to lose if it’s not accurately tracked.

Plus, unless you already have cash sitting around, you need to run to a bank or ATM to take out the money.

Check payments

Checks are easier than cash as a buyer.

However, you should always review your bank account to ensure you have the funds available to avoid a check bouncing and souring relationships with vendors.

Credit card payments

Credit card payments are great if you want to give multiple people payment authority and make online payments.

Granting corporate cards to those in charge of payments lets them operate with autonomy, but it can get tricky to stay on top of what has and hasn’t been paid when multiple people are making payments.

Bank transfers

Bank transfers allow for the direct transfer of money from one institution to the next.

An example of this is an ACH transfer (Automated Clearing House) which initiates and verifies a payment before transferring the funds to a bank account in a few business days.

This is a great option if you are buying from a supplier using a domestic bank.

Wire transfers

Wire transfers are an alternative to bank transfers.

Bank transfers require both institutions to be part of the same network.

The sender provides their bank with the recipient’s information and the institutions coordinate on transferring the amount of the receipt.

Wire transfers are electronic transfers of funds where banks don’t need to be on the same network.

Instead, a wire transfer is coordinated on a secure network (like Fedwire or SWIFT) with the transfer being completed behind the scenes once all pending transfers have been tallied.

Wire transfers are often used for international payments as they have the flexibility to send money to financial institutions outside of a bank’s usual network.

Third-party payment processors

Third-party payment processors are a hybrid of the above options.

An example of this is PayPal, which allows you to make online payments using different sources like bank withdrawal, credit card, or a balance held in the account.

Just be mindful of processing times as the 2-3 day lag of initiating a payment and the supplier receiving it can be the difference between overdue invoices and on time payments.

Which invoice payment methods are right for you?

When choosing which invoice payments to offer, consider the following:

- Where are your suppliers located? You have more options for processing domestic payments and can likely save on fees with cheaper options in cash, checks, and bank transfers.

- Who will be involved in the process? If you want multiple people to have approval authority and the ability to make payments, a corporate card minimizes the back and forth to finalize a payment.

- What options does your bank support? With direct bank transfers and wire transfers, you may incur fees to send money. If so, it’s worth working out an alternative with your supplier to save yourself money.

- What does your ideal invoice payment process look like? The more you want to automate, the more you need to lean into tech-based options with scheduled payments and simplified authorization.

- Are you making recurring payments? If you have recurring invoices with a supplier, some payment methods can be triggered by the seller. This means your suppliers get paid without processing payments yourself.

Remember that whatever payment methods you want to use, the supplier ultimately needs to accept them.

If they don’t accept your preferred method, there may be room to negotiate the terms of payment to support your team.

For example, if your supplier wants to use wire transfer but your bank charges you $10 per wire transfer, see if they’re willing to offer a discount for that amount.

You can offer early payment to incentivize them to cover the cost—everyone wants to get paid faster.

How to improve your invoice payment process

To improve your invoice payment process, focus on iterating on these aspects:

- Document the process: Every step of your payment process should be documented in your accounts payable policy.

- Have clearly defined roles: If you have multiple people involved in the invoice payment process, outline what their roles are. This prevents cases where something gets missed because everyone thought someone else was handling it.

- Have multiple payment options: We outlined six of the most common invoice payment options above. Try to make use of at least 2-3 so you have options to meet the needs of your suppliers.

- Establish clear communication: Let vendors know how you process invoices, follow-up on any questions they may have, and let them know if an invoice will be paid late.

- Automate the process where possible: Set up automation to save yourself the step of triggering a payment manually. You could use automated payments for recurring invoices or have payments trigger when the approval process is complete.

Automating the invoice payment process

Using customized workflows, have it where the AP team is notified as soon as the approval process is complete so they can make payments promptly.

Automation can make the invoice payment process a one-click task.

Once the invoice is approved, the AP team simply needs to click a single button and the payment is on its way.

Just as you should offer multiple payment options to your suppliers, so should your accounts payable solution.

Having one that supports credit cards, ACH payments, checks, and wire transfers means having each option at your fingertips without worrying about the time commitment of each payment type.

If you have a recurring invoice, set up a recurring payment that’s automatically sent on the same cadence. It’s an easy way to pay consistently on time and quickly get into your suppliers’ good books.

The catch-all solution to improve invoice payments

Much of the automation we’ve discussed can be accomplished with a change of your financial operations platform.

With BILL, the accounts payable process is streamlined with customizable workflows and flexible payment options that make managing your invoice payments a breeze.

Want to make manually managing invoice payments a thing of the past? Try BILL to see for yourself how we can improve your workflow and win you back your time.