Real time payments, also known as instant payments, facilitate the immediate transfer of funds between parties, eliminating the waiting periods typically associated with traditional forms of banking.

Real time payments offer benefits such as improved cash flow, increased transaction speed, and enhanced convenience for both businesses and consumers.

Real time payments enable instantaneous monetary transactions, thereby revolutionizing the traditional understanding of payment systems and their time frames.

Some characteristics that define a real-time payment include:

- Immediately available

- 24/7 accessibility

- Security and fraud prevention

- Regulatory compliance

What is the real time payment (RTP) network?

A critical component of the real time payments system is the RTP network, a technological infrastructure that allows for the immediate processing and settlement of transactions.

This network operates continuously, thus enabling payments to be made at any time, irrespective of traditional banking hours.

The RTP network also supports a variety of transaction types, including person-to-person transfers, business-to-business transactions, and government payments, among others.

How do real time payments work?

Instantaneous monetary transactions follow a specific process that involves immediate clearing and settlement of funds, available 24/7, all year round, and on weekends and holidays too.

This process is facilitated by real time payment systems, which are technologically advanced platforms designed to process payments swiftly and securely.

These systems are protected by tokenization, which allows for account numbers to be replaced by tokens, further protecting users from fraud and identity theft.

Real time payment process

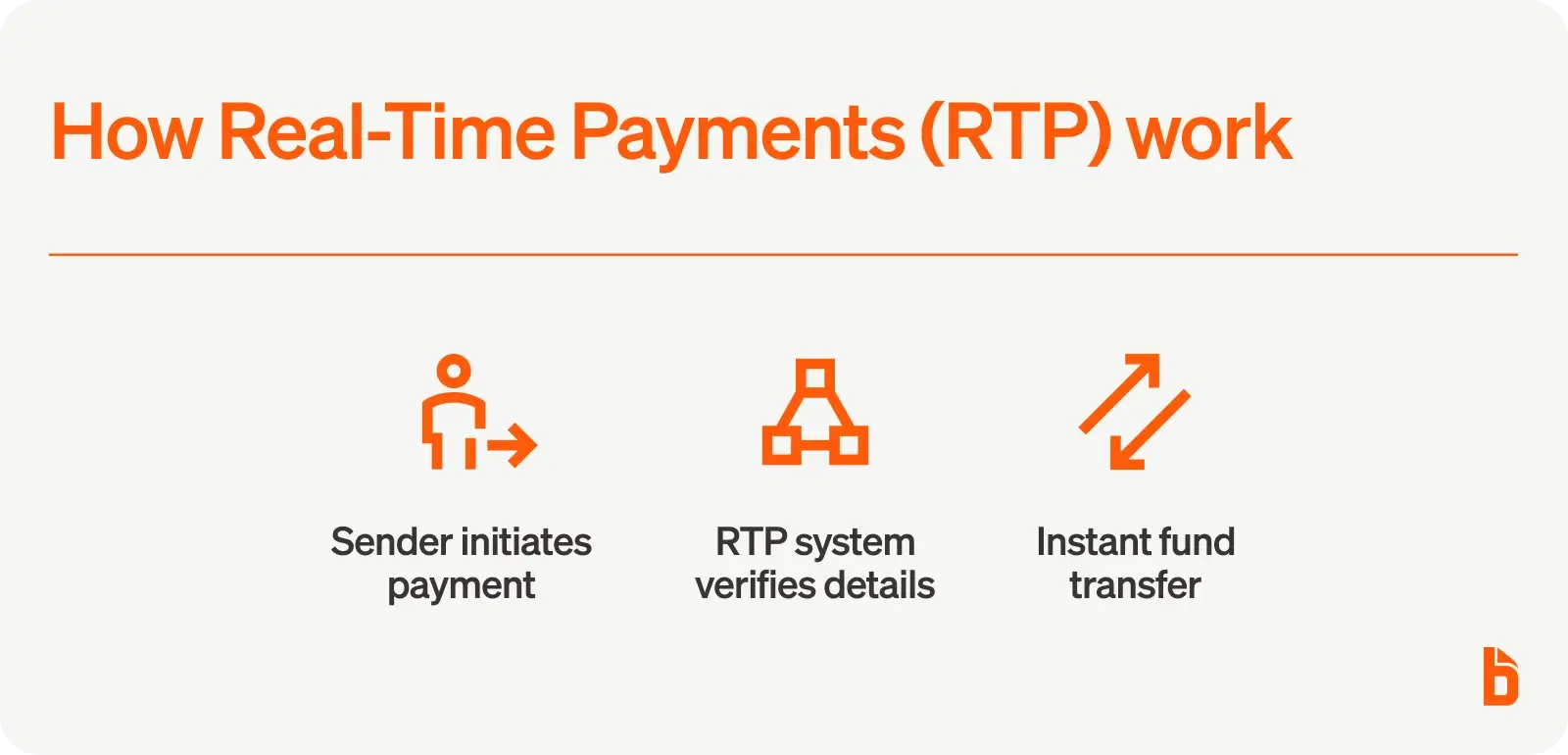

Here’s how the transaction journey goes in the real time payments network in three steps:

- The sender initiates the payment

- The RTP systems receive this transaction request and validate the details, including the recipient's bank details and transaction amount.

- Once these details are verified, the system executes the funds transfer, debiting the sender's bank account and crediting the recipient's account almost instantly.

It is important to note that these systems are designed to process payments irrespective of the time of the day or week, thus enabling users to send and receive payments seamlessly at their convenience.

Real time payment examples

Real-time payments are offered through a number of different systems.

Some of these include:

- SWIFT

- Paypal

- RTP Network

- FEDNow

Other examples of real-time payment systems throughout the world include Faster Payments in the UK, Zelle in the US, Paytm in India, and Alipay/WeChat Pay in China.

Real-time payment systems provide greater convenience, speed, and flexibility in conducting financial transactions, making them particularly useful in today's fast-paced digital economy.

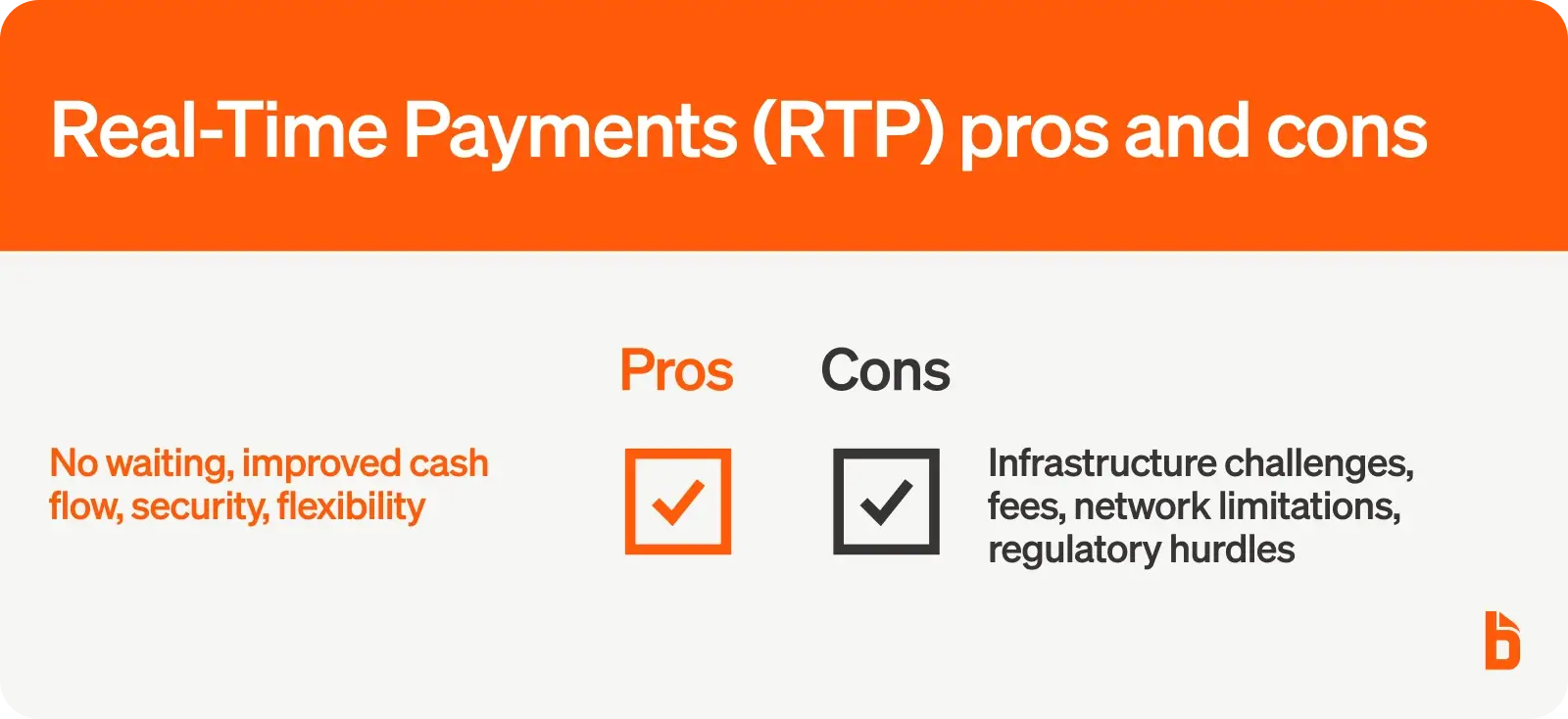

Pros and cons of real time payments

While RTPs are becoming increasingly popular in the financial industry for how quickly users can send money transfers, they come with their own set of cons.

Here are some of the main advantages and disadvantages of real-time payments.

Pros of real time payments

- No waiting periods

- Streamlined payment process

- Increased security/fraud protection

- Improved cash flow management

- Flexibility (any device, anywhere)

Cons of real time payments

- Payment infrastructure challenges

- Regulatory and compliance hurdles

- Challenges with international payments

- Fees are often associated

- Limited to a specific network like Paypal or Zelle

RTPs vs. other payment types

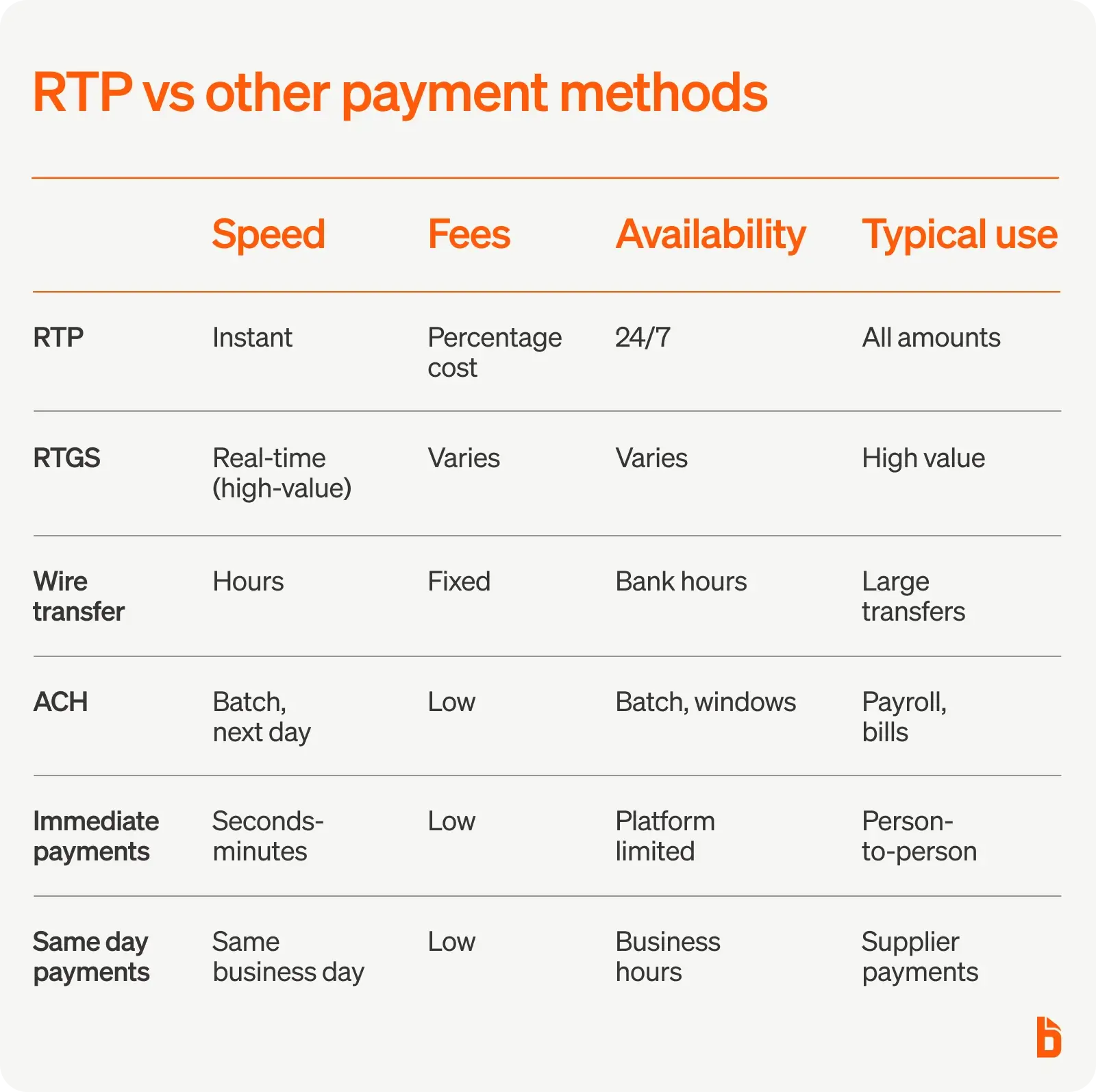

Navigating the landscape of financial transactions, one must discern where Immediate Monetary Transactions (IMT), also known as real time payments (RTP), position themselves amidst other methods such as Real-Time Gross Settlement (RTGS), Wire Transfer, and Automated Clearing House (ACH).

RTP vs. RTGS

RTGS, often used for high value transactions, is a system where the funds transfer instructions are processed and settled in real time and on a gross basis.

Real time payments, on the other hand, can be used for any amount, not just higher value transactions.

RTP vs. wire transfer

Wire transfer, on the other hand, is an electronic transfer of funds across a network, administered by hundreds of banks and transfer service agencies around the world.

Wire transfer typically has a fixed fee, whereas RTP often has a percentage cost. Depending on the amount, wire transfer or RTP may be less expensive to send.

Wire transfers are also not immediate, and may take several hours.

RTP vs. ACH

ACH transactions involve the electronic transfer of funds between banks through its network, and are generally batch processed and not in real time.

RTP transactions, on the other hand, are processed individually in real time.

RTP vs immediate payments

Immediate payments (like Zelle) are typically processed within a few seconds or minutes, still offering a quicker turnaround compared to traditional payment methods.

While they do not provide the instantaneous benefit of RTPs, immediate payments still significantly improve the speed and efficiency of money transfers, proving advantageous in scenarios where slight delays are acceptable.

Immediate payment systems such as Zelle are often limited by platform. If that is the case, payments would be sent through your bank, not your AP software, and both accounts would need to be on the same network.

RTP vs. same day payments

Same day payments offer a different approach.

These transactions are batch-processed and completed within the same business day and are subjected to cut-off timing and business hours, rather than in real-time or immediately.

While this method does not offer the immediate availability of funds, it does provide a quicker alternative to traditional methods that may take several business days.

For instance, same-day payments can be beneficial for supplier payments, where businesses need to ensure prompt payment while maintaining cash flow management.

Real time instant transfers with BILL

The advent of real-time payments has significantly transformed the financial landscape. The irrefutable advantages, including instantaneous transactions, enhanced security, and improved convenience, have fueled their adoption.

Processing payments with RTP launches you into the next generation of transaction processing. Simplify your payments with BILL's real time instant transfers today.

BILL's Instant Transfer uses RTP to offer early access to incoming payments. The service actually sends the money before it clears, then BILL sends the money instantly. If your bank isn’t RTP eligible, BILL can use a debit card to make instant payments.